So, what does it mean to start investing in art? At its core, it's about buying a piece of artwork with the hope—and educated guess—that its value will grow over time. You're not just buying something beautiful to hang on your wall; you're acquiring a tangible asset, much like you would a piece of real estate or a vintage car. It's a way to branch out from traditional investments and build wealth in a completely different arena.

What Does Investing in Art Actually Mean?

Think of it this way: when you invest in art, you’re buying a unique asset whose value dances to a different rhythm than the stock market. Forget quarterly earnings reports or corporate profits. An artwork's price tag is shaped by its rarity, the artist's reputation, its place in cultural history, and its documented ownership record—what the art world calls provenance. This makes it an incredibly powerful tool for diversifying your portfolio.

A stock gives you a sliver of ownership in a public company, but a piece of art gives you full ownership of a one-of-a-kind cultural artifact. That's a critical distinction. The art market is moved by its own unique forces, which is why it can often hold steady, or even thrive, when economic storms are rocking traditional investments.

Art As A Tangible Asset

Unlike stocks or bonds, which exist as digital entries on a screen, art is something you can actually see and touch. You can hang it in your home and enjoy it every single day. This physical reality delivers an emotional return—the pure joy of ownership—that other assets simply can't match. You become a guardian of a piece of creative history.

Of course, being a physical asset means it needs looking after. You'll have to think about things like proper storage, insurance, and maintenance, which is a bit different from letting shares sit in a brokerage account. If you're just starting, a fantastic way to get your bearings is to understand the collector's mindset from an artist's point of view. You can explore a deeper conversation about collecting art to get a feel for the process.

Understanding The Financial Performance

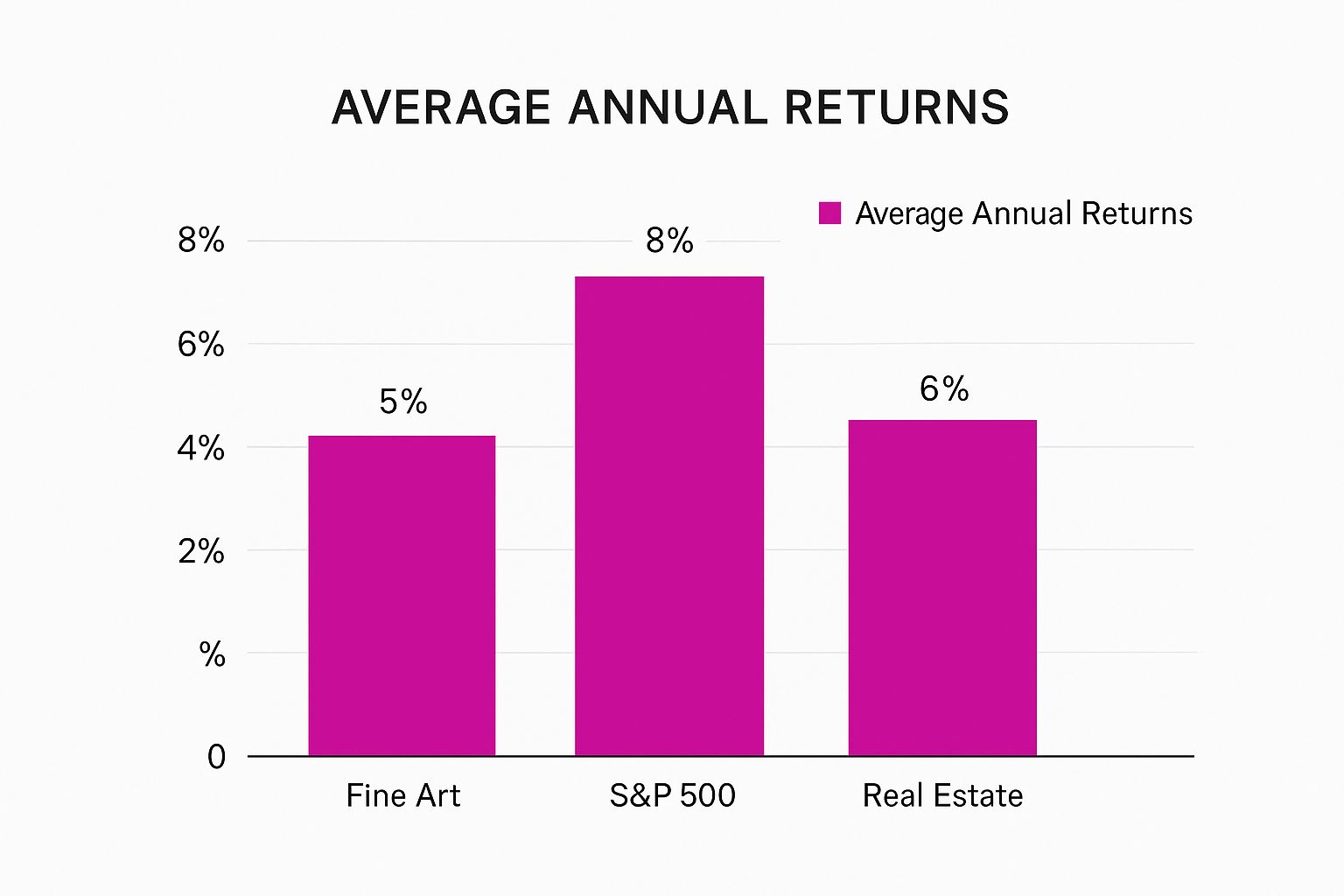

Don't let the "passion" aspect fool you; art has proven to be a surprisingly resilient and profitable investment over the long haul. Research has shown that from 1995 to 2024, fine art delivered an average annual return of 11.4%. For comparison, the S&P 500 returned 10.0% and U.S. real estate just 3.9% during that same period.

This chart really puts those numbers into perspective.

As you can see, while the stock market is a powerful engine for growth, fine art has more than held its own, proving itself to be a competitive asset class with a strong track record.

The real magic of art investing, especially for beginners, is finding that sweet spot where financial potential meets personal passion. It’s a journey that rewards research, patience, and a genuine love for creativity.

To help you better understand how art fits into the larger investment landscape, let's break down the key differences between buying art and buying stocks.

Art Investing Vs. Stock Investing: A Quick Comparison

This table offers a straightforward look at how these two asset classes stack up against each other.

| Characteristic | Art Investing | Stock Investing |

|---|---|---|

| Asset Type | Tangible, physical object | Intangible, digital share |

| Value Driver | Rarity, artist, provenance | Company profits, market sentiment |

| Liquidity | Low (can take time to sell) | High (can be sold instantly) |

| Correlation | Low correlation to stocks | High correlation to market |

| Return Type | Financial and emotional | Primarily financial |

Ultimately, the choice isn't about which is "better," but which is right for your goals. While stocks offer speed and liquidity, art provides a unique blend of financial diversification and personal enrichment.

How the Art Market Really Works

The art world can feel a bit like a members-only club from the outside, but once you pull back the curtain, its mechanics are surprisingly straightforward. At its core, the market is split into two distinct arenas: the primary market and the secondary market. Getting a handle on how each one operates is the first real step to investing with confidence.

Think of the primary market as the place where art makes its public debut. It’s the "new car dealership" of the art world. Here, galleries represent living artists and sell their brand-new creations directly to the public. When you buy here, you're the very first owner.

The Primary Market: Where Art is Born

Buying on the primary market often means you're supporting an artist at a pivotal moment in their career. You get to discover emerging talent and build genuine relationships with the artists and gallerists who champion them.

Prices are typically set by the gallery in conversation with the artist. For a beginner, this can be a much more accessible and less intimidating way to start collecting.

The Secondary Market: Where Art is Resold

The secondary market, on the other hand, is where art gets a second life. This is the domain of high-profile auction houses like Christie's and Sotheby's, as well as private sales brokered between collectors. If the primary market is the dealership, this is the classic car auction.

Here, an artwork's value is truly put to the test, proven by public demand and market trends. This is where you'll find works by established "blue-chip" artists—the big names with long track records. The history and story behind a piece, known as its provenance, play a massive role in what it sells for.

The global art market is a powerful force, valued at approximately $67.8 billion in 2024. For decades, blue-chip artworks have shown remarkable resilience, delivering steady annual returns between 7% and 10% over the last 50 years. You can discover more insights about art investment trends to get a sense of the market's stability.

What Gives an Artwork Its Value?

So, what’s the secret sauce that determines whether a painting's value will climb? It’s not just about what looks good over the sofa. It’s a blend of several key factors that build an artwork’s financial and cultural weight.

- The Artist's Career: Is the artist just starting out, mid-career, or already a household name? A career that's on the rise—marked by museum shows, positive reviews, and strong sales—is a huge driver of value.

- Provenance (Ownership History): A clean, documented history of who has owned the piece is critical. If a famous collector once owned it or it was shown in a major museum, its value can skyrocket.

- Condition: Like any tangible asset, an artwork's physical state is paramount. Damage from light, humidity, or clumsy restorations can seriously hurt its price.

- Art Historical Significance: Does the piece mark a turning point in the artist's development or represent a key moment in an art movement? Works with real historical importance are always in high demand.

When these elements come together, they create a compelling story for a piece of art, turning it from a beautiful object into a valuable asset. If you learn to look beyond the canvas, you'll start to see the hidden forces that truly drive the market.

Weighing the Rewards and Risks of Art Investing

Like any investment, putting your money into art means balancing the potential upside with the inherent risks. It’s a unique world, and before you dive in, it’s critical to understand both sides of the coin. Let’s start with what makes art such a compelling place to invest.

First and foremost, art offers fantastic portfolio diversification. The art market often dances to its own beat, separate from the frantic ups and downs of stocks and bonds. This means that when traditional markets take a nosedive, a solid piece of art can hold its value or even climb, adding a layer of stability to your overall financial picture. Art has also proven to be a reliable hedge against inflation over the long haul.

But the real magic of art investing? It's the emotional return. You're not just buying an asset; you're owning a piece of culture, a story, a spark of human creativity. It's an investment that enriches your daily life in a way a stock certificate never could.

Understanding the Potential Downsides

Alright, let's talk about the challenges. Being realistic about the risks is just as important as getting excited about the rewards, and art has a few unique hurdles you won’t find elsewhere.

The biggest one by far is illiquidity. You can't just log into an app and sell a painting in a few seconds. Finding the right buyer who’s willing to pay the right price can take months, sometimes even years. It requires patience and a good network, so art is definitely not the place for money you might need in a hurry.

Here are a few other risks to be aware of:

- High Transaction Costs: The "buy low, sell high" mantra gets complicated when you factor in fees. Auction houses and galleries take a cut, with commissions and premiums often ranging from 10% to 25% on both the buying and selling side.

- Need for Specialized Knowledge: Knowing what makes a piece valuable is an art in itself. It’s easy to overpay if you don’t have a solid grasp of the artist’s history, market demand, and the artwork's provenance. For instance, just learning how to understand abstract art is a skill that directly impacts your ability to make smart choices.

- Maintenance and Insurance: Physical art is, well, physical. It needs to be protected. The costs of proper framing, climate-controlled storage, and insurance policies can slowly eat into your potential profits over time.

By carefully weighing these pros and cons, you can decide if adding art to your portfolio truly fits your financial goals, your timeline, and your personality.

How to Start Investing in Art on a Budget

When you hear "art investing," it's easy to picture exclusive, high-stakes auctions where masterpieces sell for millions. But that's just one tiny corner of the art world. You don’t need a fortune to get started.

In fact, getting into art investing as a beginner is less about having deep pockets and more about having a smart approach. The secret is to find corners of the market where the entry cost is low but the potential is high.

Two of the best ways to do this are by focusing on up-and-coming artists and exploring the world of fractional ownership.

Discovering Emerging Artists

One of the most exciting ways to invest on a budget is to buy work from emerging artists. These are talented creators who are just starting their careers but are already showing incredible promise. When you buy their work, you're doing more than just acquiring a beautiful piece—you're betting on their future. If that artist goes on to become a household name, the value of that early work could multiply many times over.

So, where do you find these future stars? You just need to know where to look.

- University Art Shows: MFA (Master of Fine Arts) exhibitions are absolute goldmines. You get a sneak peek at the next generation of talent right as they're graduating, often before they've even signed with a gallery.

- Local Art Fairs: Smaller, regional fairs are fantastic for meeting artists face-to-face and seeing a huge variety of work all at once. That direct conversation can give you priceless insight into their creative vision.

- Online Galleries and Platforms: Websites like Artsy or Saatchi Art showcase thousands of emerging artists from all over the world. It’s a great way to discover new work from your couch, with many pieces available for under $1,000.

The goal is to train your eye and build your confidence. Start by following artists whose work genuinely moves you, visit local galleries, and talk to gallerists. The more you immerse yourself, the better you'll get at spotting potential.

This approach is a win-win. You get the thrill of discovery and the satisfaction of supporting someone's creative journey.

The Power of Fractional Ownership

Ever dreamed of owning a piece by an icon like Andy Warhol or Banksy but don't have millions lying around? That dream is more realistic than you think, thanks to fractional ownership.

Think of it like buying a single share of stock in a company like Apple. You don't own the entire company, but you own a small piece of it, and you profit as its value grows. Fractional art investing works the exact same way.

Platforms that offer this will buy a high-value painting and then issue shares to investors. This model smashes the financial barrier to entry, letting you invest with just a few hundred dollars. Suddenly, blue-chip art isn't just for billionaires. You can learn more about how fractional art platforms work and see how they’re opening up the market.

By combining these two strategies—championing new talent and buying small stakes in iconic works—you can build a diverse and meaningful art portfolio without breaking the bank.

Diving into the art world is thrilling, but it's easy to make a few classic mistakes right out of the gate. Knowing what these common tripwires are can save you a lot of headaches (and money) and help you start investing with confidence.

Buying With Your Heart, Not Your Head

The biggest mistake I see newcomers make is letting pure emotion drive the purchase. It's easy to fall head-over-heels for a piece. But just because you love it doesn't mean it's a smart investment.

Think of it this way: you can appreciate a beautiful, handcrafted sports car, but that doesn't automatically make it a vehicle that will appreciate in value. The same logic applies to art. Passion is great, but it needs to be backed by solid research.

Forgetting About the "Hidden" Costs

Another major oversight is ignoring the extra costs that come with owning a physical work of art. The price you pay the gallery or artist is just the starting point.

Remember, the sticker price is only part of the story. You also have to account for framing, professional art shipping, insurance, and sometimes even climate-controlled storage. These aren't one-time fees; they're ongoing expenses that can really add up.

If you don't budget for these, a promising piece can quickly become a financial burden. Always factor these "hidden" costs into your total investment calculation before you commit.

Rushing the Process

It’s tempting to want to see a quick profit, but many beginners get swept up in the excitement and expect overnight returns. The art market just doesn't work that way. Unlike stocks, art is a long-term play. It’s what we call an illiquid asset—it can take a long time to grow in value and even longer to sell. Patience isn't just a good quality to have here; it's fundamental to your success.

Along the same lines, another rookie error is failing to verify the artwork's history, also known as its provenance. A piece with a sketchy or missing history is a huge red flag. It’s incredibly difficult to sell something if you can't prove where it's been. Always, always ask for the paperwork and authentication.

The best way to sidestep these issues is to have a clear plan from the start. Setting solid goals is the bedrock of any smart investment strategy. To get a better handle on this, check out our guide on goals analysis and planning for creatives. A good plan keeps you grounded and helps you avoid those costly impulse buys, putting you on the right path to building a collection that's both meaningful and valuable.

Answering Your Final Questions About Art Investing

Jumping into any new investment can feel a little daunting, and art is no exception. It’s completely normal to have a few last-minute questions as you get ready to explore this world. Let's clear the air on some of the most common concerns beginners have, so you can move forward with total confidence.

Think of this as our final chat before you take that first, exciting step into the art market. We'll sort out any lingering doubts about costs, selling, and yes, even taxes.

How Much Money Do I Really Need to Start?

This is usually the first question on everyone's mind, and the answer is probably a lot less than you think. The old myth that you need to be a millionaire to buy art is just that—a myth. Today, the art world is more open and accessible than ever before.

You absolutely do not need tens of thousands of dollars to get in the game. You can actually start building a meaningful collection with a surprisingly modest budget. Here are a couple of smart ways to begin:

- Discover Emerging Artists & Prints: You can often find fantastic original works from up-and-coming artists for under $1,000. Another great route is buying limited edition prints from more established names, which gives you a taste of their work without the high price tag.

- Try Fractional Ownership: Platforms now exist that let you buy a small share of a blue-chip masterpiece, sometimes for just a few hundred dollars. It’s a brilliant way to own a piece of the high-end market without the massive capital.

The most important thing is to start at a level that feels right for you. You can always scale up as your confidence and budget grow.

Art investing isn't an exclusive club anymore. A good eye and a smart strategy are far more valuable than a huge bank account. The hardest part is simply getting started.

Is Art a Liquid Asset?

This is a really important one to wrap your head around. In the investment world, liquidity is all about how fast you can turn an asset into cash without taking a big hit on its value. Stocks are super liquid—you can sell them in seconds. Art, on the other hand, plays by a different set of rules.

Art is what we call an illiquid asset. This just means you can't expect to sell a piece overnight. Turning a painting back into cash is a process, and it takes time.

Finding the right buyer—whether you go through a gallery, an auction house, or a private sale—isn't instant. It could take a few weeks, several months, or in some cases, even longer. It’s crucial to have realistic expectations from day one.

And don't forget about transaction costs. When you sell, galleries and auction houses take a commission, which can be anywhere from 10% to 25% of the final sale price. You have to factor that into your potential returns. Think of art as a long-term play, not a get-rich-quick scheme.

How Is Profit from Art Taxed?

So you've sold a piece for more than you paid for it—congratulations! That profit is typically considered a capital gain. But this is where things get a bit tricky, because the tax rules for art aren't the same as for stocks and bonds.

In many places, including the United States, art is classified as a "collectible." The profit made from selling a collectible is often taxed at a different—and sometimes higher—capital gains rate than profits from your other investments. The exact rate can depend on your income and how long you owned the artwork.

Because tax laws are so complex and change based on where you live and your personal finances, this is one area where you absolutely should not wing it.

It is absolutely essential to speak with a qualified tax professional or financial advisor who understands collectibles. They can give you advice that's specific to your situation, helping you stay compliant and avoid any nasty surprises when tax season rolls around.

Getting an expert in your corner will help you handle the financial side of things responsibly, letting you focus on the joy of collecting.

Ready to discover art that speaks to you? At Wiktoria Florek Mixed Media Abstract Painter, we believe that art should be more than an investment—it should be an experience. Explore a collection of emotionally charged, large-scale abstract works that transform spaces and connect with the soul. Begin your journey by discovering a piece that resonates with your vision. Find your next masterpiece at wiktoriaflorek.com.