Let's get one thing straight: if you think your standard homeowner's policy is enough to protect your art, you're setting yourself up for a painful surprise. I've seen it happen too many times. The unique risks your collection faces—from a simple accident during handling to subtle environmental threats like humidity—demand a policy built specifically for art. Insuring your collection isn't just another bill to pay; it’s a fundamental part of protecting your assets and giving you peace of mind in a market where values can shift dramatically.

Why Your Art Collection Needs Specialized Insurance

So many collectors, especially those just starting out, make the mistake of assuming their art is covered under their existing home or renter's insurance. The hard truth is that these policies often have shockingly low limits for valuable personal property—sometimes as little as $2,500. That might not even cover the custom frame on a significant piece, let alone the artwork itself.

Worse yet, a typical homeowner's policy is a "named peril" policy. This means it only covers losses from a specific list of events, like a fire or a burglary. This leaves huge, gaping holes in your coverage, ignoring the most common ways art actually gets damaged.

Gaps Standard Insurance Just Can't Fill

This is where specialized fine art insurance comes in. It’s designed to fill those critical gaps. Unlike your home policy, it provides "all-risk" coverage, which is a game-changer. It essentially protects against everything unless a risk is specifically excluded in writing.

Here are the real-world risks a dedicated policy handles that a standard one almost always ignores:

- Accidental Damage: A sculpture gets chipped during a move. A canvas is accidentally torn by the cleaning crew. Believe it or not, these are some of the most frequent claims I see, and they are almost never covered by a basic policy.

- Damage in Transit: Your art is at its most vulnerable when it's on the move. A specialized policy gives you "wall-to-wall" coverage, protecting a piece from the second it leaves its spot until it’s safely installed in its new home.

- Mysterious Disappearance: This is a tough one. A piece goes missing, but there’s no sign of a break-in or forced entry. A standard policy offers zero help. Fine art insurance, however, often covers this unsettling scenario.

- Environmental Damage: The slow, creeping damage from things like light exposure, humidity shifts, or even pests is a real threat to the life of an artwork. These are all standard exclusions in homeowner's insurance.

People tend to think the only risks are big, dramatic events like a heist or a fire. From my experience, the most frequent claims actually come from accidental drops and water damage—risks that are often manageable but require the right coverage to avoid a financial disaster.

A Market That Demands Protection

The explosive growth of the art market itself makes proper coverage more critical than ever. Art is no longer just a cultural object; for many, it's a major financial asset. The global fine art insurance market is currently valued somewhere between $3.4 to $5 billion. Experts project it could grow to over $5.8 billion in the next decade. This isn't just a random statistic; it reflects the soaring value of collections and the growing recognition of art as a serious investment class. You can explore more about the fine art insurance market trends to get a better sense of the financial landscape.

Ultimately, insuring your art is about much more than getting a check if something goes wrong. It’s about gaining access to a network of world-class specialists—the conservators, restorers, and art handlers—who can help you protect and, if necessary, recover your treasured pieces after a loss. It’s simply a non-negotiable part of responsible ownership, ensuring your collection can be admired for generations to come.

Understanding the True Value of Your Art

Before you can even think about insurance, you need a rock-solid, defensible understanding of what your art is worth. It's a common mistake to rely on the purchase price from years ago or just take a guess. Honestly, that's a surefire way to find yourself underinsured when you need the coverage most. The valuation is the foundation of your entire insurance strategy, so let's get it right.

First, we need to talk about two key terms: retail replacement value and fair market value. They sound similar, but for insurance, the difference is huge.

Fair market value is what a willing buyer might pay a willing seller on the open market—think auction results or the figure used for estate taxes. But for your policy, you need to focus on retail replacement value. This is what it would cost to walk into a gallery tomorrow and buy a comparable piece from a similar artist. It's almost always higher because it factors in the gallery's commission and the reality of replacing a unique item quickly. This is the number insurers use to make you whole after a disaster.

Finding a Qualified Art Appraiser

Let’s be clear: not all appraisers are the same. The art world is incredibly specialized. You wouldn't ask a specialist in 19th-century landscapes to value a collection of contemporary street art, right? You need an expert who lives and breathes the specific niche your collection occupies.

When you're looking for a professional, check for credentials from respected organizations like the International Society of Appraisers (ISA) or the Appraisers Association of America (AAA). These groups have strict ethical codes and demand ongoing education from their members, which is a good sign you're dealing with a serious expert.

Before you hire anyone, have a conversation and ask some direct questions:

- What is your specific area of expertise? Get granular here. Make sure their background truly matches the artists and movements you collect.

- Can you provide references from collectors with similar art? Talking to past clients is one of the best ways to vet their knowledge and how they operate.

- How do you structure your fees? A reputable appraiser will charge a flat or hourly rate. If someone wants to take a percentage of the art's value, walk away. That's a major conflict of interest.

A professional written appraisal for a single piece can run anywhere from $600 to $800, so you want to be confident in the person you choose. Their final report is the single most important document you'll hand to your insurance broker.

The Power of Provenance and Documentation

You can make your appraiser's job much easier (and the valuation more accurate) by having your paperwork in order. The most critical document is the provenance—the artwork's chain of ownership. A clear, well-documented history can dramatically increase a piece's value and desirability.

The best way to ensure an insured loss is settled quickly and fairly is by properly documenting your art collection. Providing your carrier with images, acquisition paperwork, and provenance information is non-negotiable.

Before the appraiser arrives, pull together a complete file for each piece. This isn't just about proving ownership; it's about building a case for its value.

Your documentation file should contain:

- Bill of Sale: The original receipt is your starting point for ownership and cost basis.

- Exhibition History: Has the piece been shown in a gallery or museum? This adds to its cultural weight and value.

- Literature Mentions: Mentions in books, artist catalogues, or reviews all contribute to its story.

- Condition Reports: Any professional assessment of the artwork’s physical state is crucial, especially for older works.

- High-Resolution Photographs: You need sharp, detailed images of the front, back, and any signatures or unique marks.

Getting this organized not only helps the appraiser but also makes the claims process infinitely smoother if you ever have to use your policy. If this side of collecting is new to you, you can learn a lot about how to get started with collecting and documenting art from artists and experts who’ve been through it all.

Why Regular Reappraisals Are Crucial

Finally, getting an appraisal isn't a one-and-done task. The art market is anything but static; values can shift significantly in a short time.

For most established collections, getting an updated appraisal every three to five years is a good rule of thumb.

However, if you collect work by emerging or mid-career artists, their markets can be much more volatile. In that case, you should tighten that schedule to every one or two years. If an artist you own suddenly has a breakout museum show, their values could skyrocket overnight. Without an updated appraisal, you'd be left dangerously underinsured. A proactive approach here ensures your coverage always reflects your collection's real-world worth.

Understanding What's In Your Fine Art Insurance Policy

Let's be honest, insurance policies can feel like they're written in a language designed to confuse. But when your passion and investment are on the line, figuring out what your fine art policy actually says is non-negotiable. Getting this wrong isn't just an inconvenience—it can be a financially devastating mistake.

So, let's break down the critical parts of a solid fine art policy. I want you to know exactly what to look for and, frankly, what you should demand from your insurer.

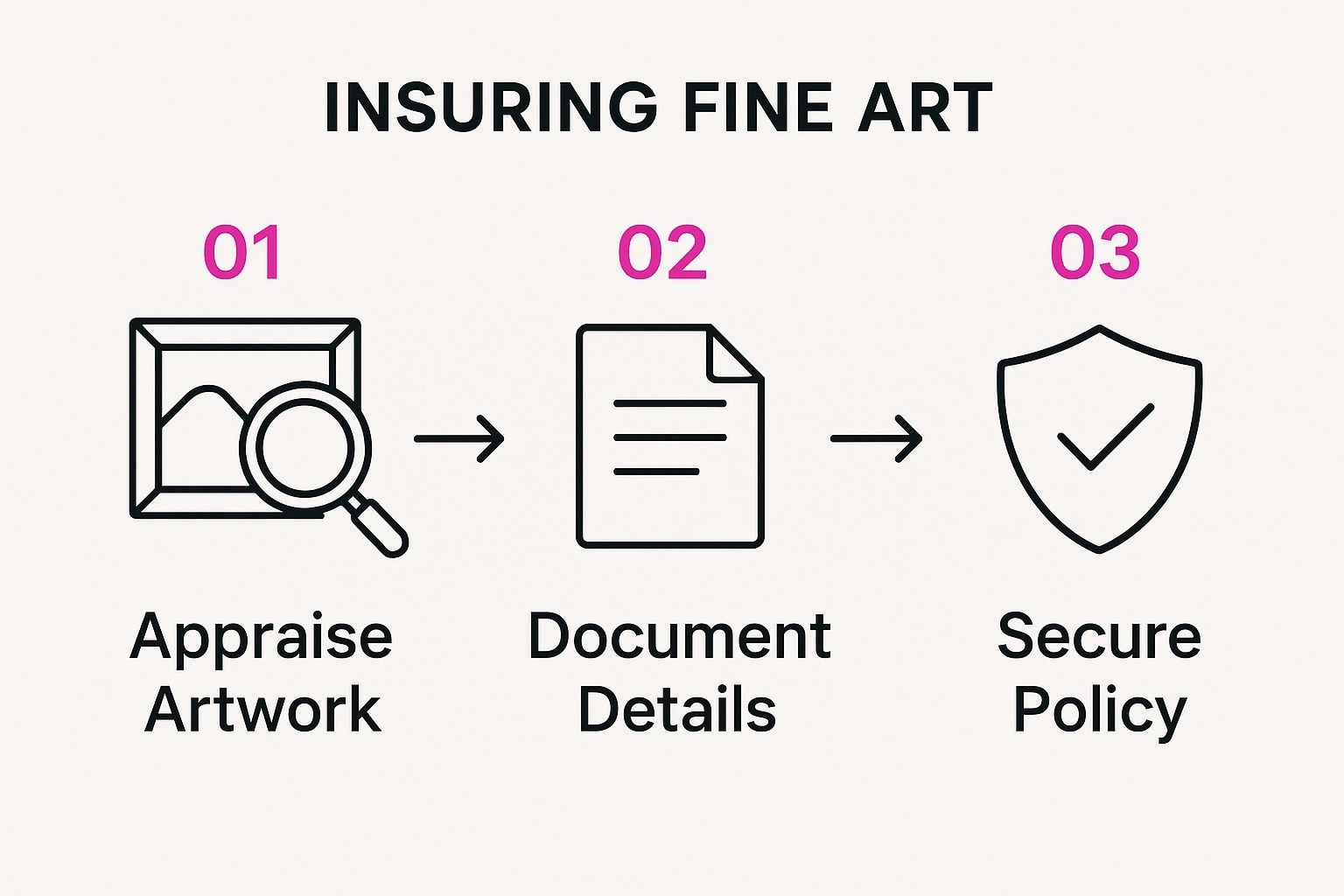

This simple path is the foundation for getting it right: you first appraise the art, then document it thoroughly, and only then do you secure a policy built on that solid information.

Each step logically builds on the one before it, making sure your coverage is based on facts, not guesswork.

The Two Non-Negotiables: Agreed Value and All-Risk

When I review a policy for a client, there are two terms I look for immediately: "agreed value" and "all-risk" coverage. If a policy doesn't have both, it's a major red flag, and I'd advise you to walk away.

- Agreed Value: This is your single best defense against market whims. It means that you and the insurance company agree on the value of each piece before the policy is even signed. If a covered work is completely destroyed, that pre-determined amount is exactly what you are paid. No arguments, no last-minute appraisals, no debates about market fluctuations. It's settled from day one.

- All-Risk Coverage: This gives you the widest possible safety net. An "all-risk" policy covers your artwork against every kind of danger, except for the handful of perils specifically named as exclusions. This is the complete opposite of a standard homeowners policy, which typically uses a "named peril" structure that only covers a very short, specific list of events like fire or theft.

With all-risk, the burden of proof flips. If something happens to your art, it's on the insurance company to prove the cause was one of those few excluded events. Otherwise, you’re covered.

Before we dive deeper, it's crucial to see just how different this specialized coverage is from what you might already have. Many collectors mistakenly believe their homeowners policy offers adequate protection. It rarely does.

Homeowners vs Fine Art Insurance Coverage

This table highlights the stark differences in how these two types of policies treat your collection.

| Coverage Feature | Standard Homeowners Insurance | Dedicated Fine Art Insurance |

|---|---|---|

| Valuation Basis | Actual Cash Value (original price minus depreciation) or Replacement Cost | Agreed Value (value is determined and locked in upfront) |

| Coverage Type | Named Peril (only covers what's listed, like fire and theft) | All-Risk (covers everything except specific exclusions) |

| Deductibles | Typically high, often per-item or per-claim | Often $0 deductible, especially for high-value collections |

| Transit & Loan | Coverage is very limited or non-existent | Wall-to-Wall (or "nail-to-nail") coverage is standard |

| Partial Loss | May only cover repair cost, ignoring loss of market value | Covers restoration and potential loss in value (diminution) |

| Claim Limits | Strict, low sub-limits for art (e.g., $2,500 total) | High limits tailored to the collection's full agreed value |

As you can see, relying on a homeowners policy for fine art is a significant gamble. A dedicated policy is built from the ground up to address the unique risks and valuation realities of the art world.

Beyond the Basics: Coverage That Truly Protects

A top-tier policy understands that art isn't static. It moves. It gets loaned to galleries, put into specialized storage, or reinstalled in a new home. Your insurance needs to travel with it.

It might surprise you to learn that the biggest threat isn't a dramatic heist, but everyday accidents. In fact, simple property damage from things like fire, water, or mishandling accounts for about 40% of the entire fine art insurance market. This reality check underscores why you need protection that goes far beyond just theft. You can explore more trends shaping the fine art insurance market to understand the landscape better.

Here are a few specific clauses you should absolutely look for:

- Wall-to-Wall Coverage: Sometimes called "nail-to-nail," this is essential. It protects an artwork from the very moment it's taken off its display hook until it's safely back in place. This covers it during transit, while on loan, and during installation.

- Pairs & Sets Clause: This is critical for works that belong together, like a diptych or an artist's series. If one piece is damaged or lost, this clause acknowledges that the value of the remaining pieces has also dropped. It compensates you for that loss, not just for the one item that was harmed.

- Title Defense Coverage: This helps pay your legal bills if someone challenges your legal ownership of a piece. With provenance histories sometimes being murky, this is an incredibly valuable safeguard against costly disputes.

I once worked with a collector whose large sculpture was slightly chipped by an installation crew. It was a heart-stopping moment for him. But because his policy had strong accidental damage coverage and the insurer had a great network, the claim was handled beautifully. The insurer paid for a top-tier conservator to perform a near-invisible restoration, and there was no loss in the work's value. That's the kind of partner you want.

Key Questions to Ask Any Potential Insurer

When you're shopping for coverage, you're in the driver's seat. Don't be afraid to ask tough, specific questions to make sure you're getting the protection you think you are. You need to be confident they can handle the unique challenges of protecting art.

Think about real-world scenarios. What if a new painting you acquired develops subtle mold damage because the storage facility's humidity controls failed? Is that covered? How? What if an expert deems it a total loss?

Get ahead of these issues by asking pointed questions:

- How do you handle claims for partial damage? Do I have a say in choosing the conservator for the restoration work?

- What are your policy's specific exclusions? Ask them to walk you through items like wear and tear, inherent vice, or damage from political risks.

- Can you explain your exact process for damage that happens while a piece is in transit or on loan to a museum?

- If a work is damaged but successfully restored, how do you address the "loss in value," or diminution, it might suffer on the open market?

Getting clear, straightforward answers to these questions is the final piece of the puzzle. It ensures the policy you're paying for is the real, comprehensive protection you'll actually get when you need it most.

Selecting the Right Insurance Partner

When you insure a significant art collection, you're not just buying a policy. You're forging a relationship. The right partner is more than a faceless company; they're a trusted advisor who understands the nuances of the art world and acts as your first call when disaster strikes. Honestly, choosing this partner is one of the biggest decisions you'll make to safeguard your assets.

The first fork in the road is deciding between working directly with an insurance carrier or bringing in a specialized art insurance broker. Going direct can seem straightforward, but a dedicated broker often provides a critical advantage. Why? Because they work for you, not the insurance company.

A good broker doesn't just find you a policy; they find you the right policy. They'll shop your collection to multiple carriers to secure the best terms and pricing. Even more important, a broker becomes your advocate during a claim, using their industry clout to make sure the process is fair and efficient. For most serious collectors, that expertise is invaluable.

Vetting Your Potential Partner

Whether you opt for a broker or go straight to a carrier, you need to do your homework. You're looking for someone with deep, specific knowledge of the art market—not just a general grasp of high-value property. Their experience is your safety net.

You really see what an insurance partner is made of when a claim occurs. You need someone with a proven history of managing complex art claims, from a small chip during installation to a total loss from a fire. Don't be afraid to ask for real-world (anonymized) case studies of how they’ve handled situations that could potentially affect your own collection.

Beyond claims, a truly great partner has a strong network of specialists on speed dial. This should include world-class conservators, appraisers, art handlers, and secure storage facilities. Their ability to connect you with the right expert at a moment's notice can mean the difference between a successful restoration and a permanent loss in value.

A partner's true worth is revealed not when you sign the policy, but when you file a claim. Their network of specialists and their experience in navigating the claims process are the most critical services they provide.

The Essential Vetting Checklist

When you sit down with a potential insurer or broker, it's time to ask the tough questions. Their answers will tell you everything you need to know about their expertise and commitment. This isn't just another transaction; it's about establishing trust.

Use these questions as a starting point for your conversation:

- Claims Handling: "Walk me through your claims process for partial damage. Who gets to choose the conservator? And how do you calculate the loss in value after a piece has been restored?"

- Specialized Knowledge: "What’s your experience with the specific artists or media in my collection? Are you comfortable with contemporary installations or digital art?"

- Risk Management: "Beyond just writing a policy, what practical advice can you offer to help me protect my collection before something happens?"

- Network Access: "If I needed a conservator or a specialized shipper, how would you connect me to your network? What does that process look like?"

- Policy Flexibility: "How does your policy handle new acquisitions? What about when I loan a piece to a museum or have art in transit?"

You're listening for confident, detailed, and clear responses. Vague answers are a major red flag. This conversation is your chance to see if they view your collection as numbers on a page or as a unique portfolio of cultural assets that demand specialized care. Choosing well gives you a peace of mind that no policy document alone can provide.

Taking Care of Your Art: A Proactive Approach

While a good insurance policy is your financial backstop, the best claim is always the one you never have to make. Truly protecting your collection starts long before you ever talk to an underwriter. It's about being a proactive custodian of your art.

Think of it this way: insurance is reactive, kicking in after a loss. Your preservation strategy, on the other hand, is all about preventing that loss in the first place. Taking these steps not only preserves the art itself but also shows insurers you’re a responsible owner, which can often lead to better policy terms.

Create a Stable, Controlled Environment

Art is far more delicate than most people realize. The very materials of a painting, sculpture, or print can be slowly and silently damaged by subtle changes in the environment. The goal is to create a museum-quality space in your own home, focusing on three big culprits.

-

Light: Sunlight and even harsh artificial light are the enemies of art. Their UV rays cause irreversible fading and decay. A simple rule of thumb is to keep your most valuable pieces out of direct sunlight. For windows in a room with art, installing UV-filtering film is a smart, one-time investment. When it comes to lighting, switch to low-UV options like LEDs and never place them too close to the artwork.

-

Temperature: Wild temperature swings are bad news. They cause materials to expand and contract, leading to cracked paint, warped canvases, or damaged frames. You want consistency. Aim for a steady temperature, ideally between 65-75°F (18-24°C), and be mindful of placement—avoiding spots near radiators, fireplaces, or drafty vents.

-

Humidity: This one is a balancing act. Too much moisture encourages mold and can make paper buckle; too little makes materials brittle and fragile. The sweet spot is generally between 45-55% relative humidity. You can easily monitor this with an inexpensive hygrometer and use a humidifier or dehumidifier to keep things stable.

These aren't just fussy habits for museum curators. They are the absolute fundamentals for anyone serious about preserving their collection’s longevity and value.

Layer on Smart Security Measures

Beyond the slow-moving threats of the environment, you have to think about physical security. The measures you take should feel appropriate for the value of your collection, creating layers of defense that make your home a less appealing target.

A professionally installed and monitored security system is the bare minimum. This should cover all entry points—doors and windows—and include motion detectors. For more valuable collections, adding glass-break sensors and video surveillance provides another crucial layer of protection.

And don't forget about fire. Basic smoke detectors are essential, of course, but a system that automatically alerts a central monitoring station offers far greater peace of mind. For truly irreplaceable pieces, collectors sometimes invest in specialized fire suppression systems. Instead of water from a traditional sprinkler—which can be just as destructive as the fire itself—these systems use gas or mist to extinguish a blaze without ruining the art.

The best risk management combines physical deterrents with impeccable records. An alarm might scare off a thief, but it’s your detailed, digitized inventory that makes a swift and successful insurance claim possible if the worst happens.

Master the Art of Documentation

I can't stress this enough: your records are your most powerful tool. If a piece is stolen or lost in a fire, your ability to prove its existence, condition, and value rests entirely on your documentation. A folder of paper receipts is a start, but in this day and age, a digitized inventory is non-negotiable.

For every piece you own, you should have a dedicated digital file containing:

- High-Resolution Photos: Get clear shots of the front, back, any signatures or markings, and close-ups of unique details or pre-existing blemishes.

- The Core Data: Artist's name, the work's title, its dimensions, the medium, and the creation date.

- Proof of Ownership: Scan the original bill of sale, any certificates of authenticity (COAs), and documents detailing the piece’s provenance or history.

- Appraisal Reports: Keep all current and past appraisals. This creates a clear history of the work's value over time.

Once you have this digital archive, back it up obsessively. Don't just save it to your computer. Keep one copy on a local hard drive, a second on an external drive that you store off-site (like at an office or a family member's home), and a third in a secure cloud service. This redundancy means that even if your home and computer are gone, your vital records are safe.

For artists and creatives juggling many pieces, applying some good time and project management principles to this process can turn a daunting task into a manageable habit.

By taking these steps—controlling the environment, securing your home, and keeping flawless records—you shift from being a passive owner to an active guardian. It's a commitment that insurers notice, but more importantly, it's the best thing you can do to ensure your collection is protected for years to come.

Common Questions About Insuring Fine Art

Even after doing your homework, a few questions about insuring a fine art collection almost always pop up. It's completely normal. The world of art insurance has its own language and nuances, so let's clear up some of the most common things collectors ask me about.

My goal here is to give you clear, straightforward answers. I want you to feel confident that you're making the right moves to protect your art.

How Often Do I Need to Reappraise My Art?

This is a big one, and there's no single answer—it really hinges on what's in your collection.

If you primarily collect established, blue-chip artists, getting an updated appraisal every three to five years is generally a safe bet. Their market values tend to be more stable, so this cadence keeps your coverage aligned without unnecessary expense.

But what if you love collecting emerging or mid-career artists? Their markets can be incredibly dynamic. A rave review, a sold-out gallery show, or a museum acquisition can cause an artist's value to skyrocket seemingly overnight. For these works, you need to be more vigilant. I recommend a fresh appraisal every one or two years to ensure you aren't left underinsured after a career-defining moment.

The biggest mistake a collector can make is letting appraisals gather dust. An outdated valuation is a direct path to being underinsured, leaving you with a huge financial gap if you ever have to file a claim.

Does Insurance Cover Art on Loan to a Museum?

Yes, it should—but only if you have the right kind of policy. What you're looking for is a feature called "wall-to-wall" or "nail-to-nail" coverage. For any collector who lends their work, this is non-negotiable.

This coverage is designed to protect your piece from the very moment it's taken off your wall until it's safely hung back in its place. It covers all the risky points in between, including:

- Packing and Crating: Protection while the artwork is professionally prepped for travel.

- Transportation: Coverage for the journey to and from the museum.

- Installation and Deinstallation: Safeguards against any mishaps during the hanging process.

- Exhibition Period: Protection while your piece is on public display.

Always double-check the fine print of your policy to confirm this coverage. It's also a great idea to hear from artists and curators who deal with loans all the time. Many share their real-world experiences in discussions like these informative studio talks.

What Is the Difference Between Agreed Value and Market Value?

Getting this right is absolutely critical.

An "agreed value" policy is the gold standard for art collectors. Here's how it works: You and the insurer agree on the specific value of each piece before the policy starts, based on a professional appraisal. If you suffer a total loss, you get that exact amount. No arguments, no last-minute negotiations.

A "market value" policy, on the other hand, pays out based on what the art was worth at the time of the loss. The art market can dip and dive, so this creates uncertainty. A market downturn could mean your payout is far less than what your art was originally appraised for.

My advice? Always insist on an agreed value policy. It's the only way to eliminate guesswork and ensure your financial protection is locked in.

At Wiktoria Florek Mixed Media Abstract Painter, we believe that collecting art should be a journey of passion and discovery, supported by smart, proactive protection. We create emotionally charged, collector-grade artworks that are more than just an aesthetic choice—they are an investment in meaning and presence.

Explore the collection and find a piece that speaks to you. Discover more at https://wiktoriaflorek.com.