So, you're trying to figure out what a piece of art is really worth. It's less about a magic formula and more about playing detective. The final price tag you see on an artwork is a culmination of its backstory, its physical state, the artist's standing in the art world, and, of course, what people are willing to pay for it right now.

Decoding an Artwork's Financial Worth

What actually gives a piece of art its value? It’s a fascinating blend of hard facts and the kind of prestige you can't quite put your finger on. Learning to value art is like learning a new language—once you understand the grammar, you can start to see why one piece might be historically significant but sell for a modest sum, while another, seemingly simple work, fetches a fortune at auction.

This isn't about pinpointing one exact number. Your goal is to build a logical, evidence-backed case for a value range. You're essentially piecing together the story of the artwork’s worth, one clue at a time.

The Core Pillars of Art Valuation

Think of an artwork's value as a structure built on four key pillars. If one is shaky, the whole valuation can be off. Miss one, and you’re not getting the full picture.

-

The Artist's Significance: First, who made it? Are we talking about an up-and-coming artist fresh out of school, a solid mid-career professional, or a blue-chip master whose work consistently sells for millions? An artist’s exhibition history, critical acclaim, and overall place in the art history books are huge drivers of value.

-

Provenance and History: This is the artwork's biography—its chain of ownership from the moment it left the artist's studio. A clean, well-documented provenance that includes famous collectors, top-tier galleries, or museum exhibitions can seriously boost a piece's value. It’s the ultimate proof of authenticity and desirability.

-

Condition: You have to look closely at the physical object. Has the color faded? Are there cracks in the paint, known as craquelure? Has it been restored, or worse, damaged by water or a clumsy mover? A piece in pristine condition will always be worth more than an identical one that's seen better days.

-

Market Appetite: Art markets are trendy, just like fashion. The demand for a particular style, artist, or movement can spike or cool off. An artist's market can catch fire overnight if they're featured in a major museum show, for example. You have to gauge the current mood.

A classic rookie mistake is getting star-struck by a big name. A minor painting in poor condition by a world-famous artist might be worth less than a masterpiece in perfect condition by a respected but less famous artist. Context is everything.

Beyond the Obvious Factors

The big four are just the start. Other, more subtle details can sway the price. The medium often matters—an oil on canvas typically commands more than a drawing on paper. Size can be a factor, and so can the subject matter.

Even the timing within an artist's career is critical. A piece from a breakthrough, celebrated series will almost always be more valuable than something from a less significant period.

Take abstract art, for instance. It requires a completely different approach to appreciate. To value it correctly, you need to understand the ideas and techniques involved. If you're new to this, it’s worth taking the time to how to understand abstract art to really get a handle on its intrinsic qualities. This knowledge helps you see past your personal taste and evaluate the work based on its technical and historical merit.

Ultimately, valuing art is about gathering all these threads to weave a complete and compelling story of its worth.

The Detective Work of Tracing Provenance

An artwork's history is its story, and a powerful story can send its value soaring. This is where you put on your detective hat. Provenance is the documented chain of ownership for a piece of art. Think of it as the work's official biography, and it's one of the most critical factors in art valuation. This paper trail proves a work is the real deal and traces its life from the artist's studio right into your hands.

A rock-solid provenance can be the deciding factor between a minor piece and a multi-million-dollar masterpiece. It builds confidence, confirms authenticity, and adds a whole other layer of desirability.

Imagine you have two nearly identical paintings. One has a documented history of ownership by a famous collector and was once exhibited at a major museum. The other just… appeared on the market. Which one do you think will command a higher price? It's no contest.

Where the Investigation Begins

Your first move should always be to carefully examine the artwork itself—specifically, the back. The reverse side of a canvas or frame, which we call the verso, can be a treasure map of its past life. It’s often covered in clues that can kickstart your research.

Here’s what you’re looking for on the verso:

- Gallery Labels: These can give you the gallery's name, the artwork's title, the artist, and sometimes an inventory number. It’s a direct breadcrumb to where it was sold or shown.

- Auction House Stickers: Big names like Christie’s or Sotheby’s often use labels with lot numbers. You can trace these right back to their historical sales archives.

- Exhibition Tags: Finding a tag from a museum show is a huge win. It places the work at a specific, important event in art history.

- Collector Stamps or Signatures: Previous owners sometimes literally leave their mark, giving you a direct link in the chain of ownership.

Every label and stamp is a thread. Your job is to pull on them, using online searches and archives to weave together the artwork's story. For instance, a label from a small New York gallery in the 1960s gives you a specific time and place to start digging into that gallery’s exhibition history.

The Gold Standard: The Catalogue Raisonné

In the art world, the catalogue raisonné is the holy grail of authentication. This is a comprehensive, scholarly book listing every known work by a particular artist, almost always compiled by the world's foremost expert on them. Getting into the catalogue raisonné is the highest form of validation a piece can receive.

If your artist has a published catalogue raisonné, your next step is non-negotiable: check if your artwork is in it. A "CR" number is like a Social Security number for an artwork, cementing its place in the official record. If a piece isn't in the catalogue, it raises some serious red flags about its authenticity.

Here's a key takeaway for any collector: the art market pays for certainty. An unbroken, documented provenance, backed by a listing in a catalogue raisonné, minimizes risk for everyone. That certainty is precisely what you’re paying a premium for.

A Word on Certificates of Authenticity

So, what about a Certificate of Authenticity (COA)? While it sounds impressive, a COA is only as credible as the person who signed it.

The best-case scenario is a COA directly from the artist or their official estate. A certificate from a respected gallery that represented the artist during their lifetime also carries a lot of weight.

But be very careful. Generic COAs issued by third parties with no real connection to the artist are often completely worthless. Some are even created to give a false sense of security for forgeries or unauthorized prints. Always, always investigate who issued the certificate.

The market itself shows us why this documentation is so vital. Recent reports show that even with global art sales dipping slightly to $65 billion, sales through private dealers have stayed strong. This tells us that collectors are leaning on trusted, relationship-based transactions rather than the frenzy of public auctions. For anyone learning how to value art, this trend proves that a solid provenance is more critical than ever. You can read more about how market dynamics influence art valuation to see the bigger picture.

Conducting a Thorough Condition Assessment

Once you've traced an artwork's history, the next piece of the puzzle is its physical health. Art is tangible. It's an object that lives in the real world, and over time, it can suffer from accidents, poor storage, or simply the effects of age. The condition of a piece isn't just a minor detail—it's a critical factor that can make or break its value.

You don’t have to be a trained conservator to do an initial check-up. Honestly, a sharp eye and knowing what to look for can help you spot the most common red flags. Your goal is to learn the difference between the charming patina that comes with age and serious damage that kills market value.

Your Initial Once-Over

Start with a general overview. Look at the artwork in good, even lighting—natural light is best if you have it. Step back to take in the whole piece, then get right up close to inspect the finer details. Don't be shy about using a magnifying glass or even the flashlight on your phone. Holding a light at an angle is a great trick for revealing surface texture, bumps, and hidden imperfections.

This first pass is all about getting a baseline feel. Does it look structurally sound? Are the colors rich and vibrant, or do they look washed out and faded? Trust your gut; first impressions often point you in the right direction.

Building a Condition Checklist

Every medium has its own set of potential problems. A painting on canvas is vulnerable to different issues than a bronze sculpture or a delicate work on paper. To keep your inspection organized, it helps to run through a mental checklist based on what you're looking at.

For Paintings (Oil or Acrylic)

- Surface Cracks: Look for fine, web-like cracks, a phenomenon called craquelure. On an older painting, a little craquelure is completely normal and can even help prove its age. But if you see deep, wide cracks (sometimes called "alligator" cracking), it could signal a deeper structural issue.

- Color and Varnish: Is there a yellow or brownish tint across the surface? That’s often a sign of an old, deteriorating varnish layer. Also, check for faded colors, which is a classic sign of too much exposure to sunlight.

- Hidden Repairs: This is where a blacklight (UV light) comes in handy. In a dark room, shine it on the painting. Modern paints used for restoration will almost always fluoresce differently than the original, older pigments, revealing touch-ups the naked eye would miss.

- Canvas Integrity: Flip the painting around and look at the back. The canvas should be tight, like a drum. Check for any patches, rips, punctures, or water stains, as these will all significantly pull down the value.

For Works on Paper (Drawings, Prints, Watercolors)

- Foxing: These are small, rust-colored spots that pop up on paper over time. They're caused by mold or tiny iron particles in the paper itself. A few spots might be okay, but widespread foxing is a major concern.

- Mat Burn: Look for a brownish border on the paper where it touched an old, acidic mat board. It's a very common problem, but it's still damage.

- Fading: Watercolors and some printing inks are incredibly sensitive to light. A good way to check for fading is to compare the colors in the main image with the colors hidden under the mat or frame, which are usually better preserved.

For Sculptures

- Material Health: For a bronze piece, look for green spots (corrosion) or an unnatural-looking patina that might hide a flaw. For marble, search for chips, cracks, or deep stains. And for wood sculptures, inspect for any signs of cracking, rot, or insect damage.

- Structural Soundness: Make sure the sculpture is stable and that all its parts are firmly attached. Any previous breaks or repairs are potential weak points.

It's crucial to distinguish between acceptable wear and significant damage. A minor, professionally restored tear on a 19th-century canvas might reduce its value by 30%, but a large, poorly repaired hole could make it nearly unsaleable.

When It's Time to Call in a Professional

Your own inspection is an essential first step, but sometimes you need an expert opinion. If you find something major—like a big tear, flaking paint, or what looks like a clumsy past repair—it's time to find a professional art conservator.

A conservator can provide a formal condition report. This is a highly detailed document that lays out the artwork's exact state, notes all existing damage and past restorations, and can even suggest treatment options. This report is an incredibly valuable tool for finalizing a valuation, especially if you're getting insurance or preparing for a major sale. Think of it as the ultimate health report for your artwork, giving you an objective basis for its true market standing.

Using Market Data to Establish Value

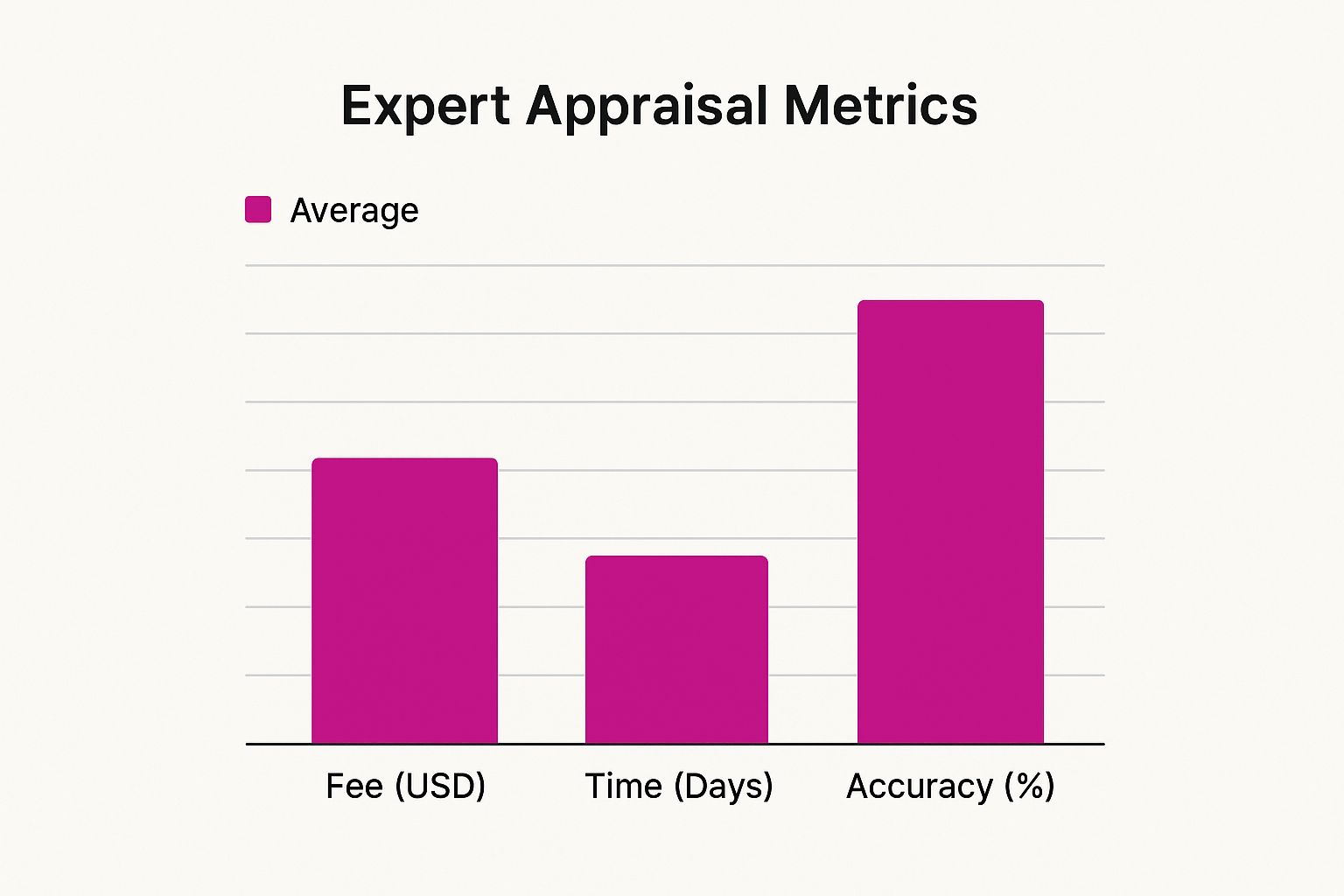

The chart above gives you a quick visual on the trade-offs between different valuation methods. As you can see, a formal appraisal costs more and takes longer, but the confidence you get in the final number is significantly higher.

Once you’ve dug into an artwork’s history and given it a thorough physical check-up, it's time to see how it stacks up in the real world. A piece of art doesn't have value in a vacuum. Its price is directly tied to what similar works—what we call comparable sales or "comps"—have recently sold for.

This is where you move from instinct and observation to cold, hard market analysis. It's the step that turns a gut feeling into a valuation you can actually stand behind with evidence.

Tapping into Art Market Databases

So, where do you find this crucial data? Your best bet is the specialized online databases that track auction sales from all over the globe. Think of them as the Zillow or Rightmove of the art world—they give you a transparent look at what people are really paying.

There are a few industry-standard platforms you should know about:

- Artnet: This is a true powerhouse. Its Price Database is massive, with millions of auction results going back decades from thousands of auction houses. It's often the first stop for professionals.

- Artprice: Another global leader, Artprice provides deep market data and analytics that are invaluable for serious collectors and advisors.

- AskART: If you’re dealing with American art, AskART is a fantastic resource. It’s rich with auction records, artist bios, and even gallery affiliations.

Most of these are subscription services, but if you're serious about getting an accurate valuation, the investment is usually well worth it. The ability to filter searches with incredible precision is what allows you to find truly relevant comps.

Finding True "Comparables"

Just typing in an artist's name and hoping for the best won't cut it. For a valuation to be accurate, you need to find artworks that are as close a match as possible to your own.

When you're sifting through the databases, you're on a mission to find artworks that mirror yours across a few key criteria.

To get a true comparison, you need to match your artwork against others based on several factors. The closer the match, the more confidence you can have in the resulting value estimate.

Key Factors for Comparing Artworks

| Valuation Factor | What to Look For | Impact on Value |

|---|---|---|

| Artist | The specific artist who created the work. | This is the most fundamental starting point for any comparison. |

| Medium | Oil on canvas, watercolor, bronze sculpture, lithograph print, etc. | A major driver of price; an oil painting is valued very differently than a print. |

| Size | The dimensions (height and width) of the artwork. | Larger works by an artist often command higher prices. |

| Date of Creation | The year the piece was made. | Works from an artist's most sought-after period are typically more valuable. |

| Subject Matter | Portrait, landscape, abstract, etc. | Some subjects are more desirable to collectors and can fetch higher prices. |

The goal is to tick as many of these boxes as you can. If you can find three to five really strong comparable sales, you’re in a great position to establish a reliable value range.

A word of caution: It's tempting to latch onto a single, sky-high auction result. Don't. Markets can be emotional. A bidding war between two determined collectors can push a price far beyond its typical market value. Always look for a consistent pattern across several sales to find a realistic baseline.

How to Read the Numbers

Once you’ve compiled your list of comps, you need to understand what the figures mean. Auction results come with some specific terminology.

- Pre-Sale Estimate: This is the auction house's educated guess of what the piece might sell for. It’s a marketing tool to attract bidders, not a formal valuation.

- Hammer Price: This is the winning bid when the auctioneer's hammer falls. It's the pure price of the artwork before any fees.

- Price Realized (or Buyer's Premium): This is the final price the buyer paid, which includes the hammer price plus the auction house’s commission. For your valuation, this is the most important number.

Finally, don't forget the bigger picture. The overall health of the art market matters. For instance, recent reports showed the global art market's total sales hit $57.5 billion, but that was a 12% decline, mostly felt at the very high end. At the same time, the number of artworks sold actually rose by 3% to 40.5 million, with strong sales for dealers with turnover under $250,000.

This tells us the market is still very active, especially at more accessible price points. You can discover more about how global trends affect art valuation to see if your piece sits in a hot or cooling segment. This context is the final touch that helps you refine your valuation from a good estimate to a truly informed one.

Navigating Online Tools and Digital Markets

The art world has gone digital, and that's a huge advantage for anyone trying to figure out what a piece is worth. Forget the old days of being locked out of dusty archives. Today, a massive amount of information is right at your fingertips, from real-time auction results to an artist's social media buzz.

Getting comfortable with these digital resources isn't just a nice-to-have skill anymore—it's essential. These platforms have pulled back the curtain, giving us access to data that was once the exclusive domain of a few elite insiders. The real trick, of course, is knowing which tools to trust and how to read between the lines of the data they provide.

Tapping into Premier Art Databases

If you want to do this right, your first stop should be a high-quality art database. Yes, the best ones are subscription-based, but the investment pays for itself in the quality of the data. I'm talking about platforms like Artnet and Artprice, which are the gold standard. They compile millions of auction results from houses big and small, all over the world.

Think of yourself as a detective when you use these tools. Don’t just type in the artist's name and call it a day. You need to dig deeper. Use their advanced filters to slice the data by:

- Medium: Is it a unique oil on canvas, a bronze from an edition of 10, or a lithograph? Each has its own market.

- Size: A monumental canvas will almost always command a different price than a small study.

- Creation Date: A work from an artist’s celebrated "blue period" is a world away from an early, experimental piece.

- Signature and Markings: Is it signed? Dated? Does it have a gallery label on the back? These details matter.

Just look at what a database can show you. This record from the Artnet Price Database gives you the whole story: the image, dimensions, the auction house's estimate, and what it actually sold for.

This is where the magic happens. By analyzing this kind of data, you can spot trends, see how an artist's market is behaving, and build a valuation grounded in solid evidence.

The New World of Online Auctions and Marketplaces

The rise of online-only auctions and sprawling marketplaces like Artsy has completely changed the game. It's not just about buying and selling anymore; this shift has created an ocean of new, public data points. A decade ago, it was nearly impossible to track an emerging artist's sales. Now, you can see their market develop in real-time.

These platforms are also a great gauge of an artist's current heat. I always look at the number of followers an artist has, the volume of inquiries on their work, and which galleries are representing them. These are all strong clues about rising demand. If you're looking to buy, browsing these sites can lead to some incredible finds. You can discover unique original art from artists who are just about to take off, alongside works by established names.

An Insider's Take: Always check the "buy-in" rate for an artist at auction—that's the percentage of their works that go unsold. A high buy-in rate is a major red flag. It can mean the market is cooling off or, more often, that the auction estimates were just too greedy.

Don't Forget About Private Sales

As much as we love transparent auction data, a huge chunk of the art market—some estimate over 50%—happens behind closed doors in private sales. While digitalization has made the public market more accessible, it has also boosted the private market, which offers discretion and negotiation room you just don't get at auction.

These private deals can set prices that are wildly different from what you see in public, especially when the auction market gets a bit sluggish. This is the part of the market that often keeps things moving. To get a truly accurate valuation, you can't ignore these transactions.

This is where the real work comes in. It means picking up the phone and talking to gallery owners, advisors, and other experts who know the private market for a specific artist. Blending this kind of "soft" intelligence with the hard data from auction databases is what truly separates a decent valuation from a professional one.

Knowing When to Call in a Professional Appraiser

Doing your own homework on an artwork’s value is a fantastic skill to develop. But let’s be real—sometimes, a well-researched guess or a price range from a database just won’t cut it. There are specific, high-stakes situations where you absolutely need a formal, legally sound valuation from a certified professional.

Think of it this way: a professional appraisal isn't just about getting a number. It's about getting a detailed, official document that will hold up under the scrutiny of insurance carriers, the IRS, or in a courtroom. Trying to save a few hundred dollars by skipping this step can end up being a very expensive mistake down the road.

When a DIY Valuation Isn't Enough

A professional appraiser is your expert witness. You bring them in when the artwork's value has serious financial or legal consequences. These are the moments when you need to put down the auction catalogs and pick up the phone to call a pro.

Here are the most common scenarios where a certified expert is non-negotiable:

- Insurance Coverage: To properly insure a significant piece, the insurance company needs an appraisal to set the Replacement Value. This is what it would cost to buy a comparable work on the retail market if yours were lost or damaged.

- Estate Planning and Taxes: When art is part of an estate, tax authorities like the IRS require a formal appraisal to establish its Fair Market Value. This isn't just a suggestion; it's a requirement for tax purposes.

- Charitable Donations: If you’re donating art and want to claim a tax deduction—especially for pieces valued over $5,000—the IRS mandates a qualified appraisal. No exceptions.

- Divorce or Legal Disputes: In any legal battle where assets are being divided, a formal appraisal provides an objective, third-party valuation that stands up in court.

- Major Sales: For a particularly valuable or rare artwork, an appraisal from a respected name can give potential buyers the confidence they need to meet your price, essentially validating the seven-figure ask.

It’s a common mistake to think an auction house estimate is the same as a formal appraisal. It's not. An auction estimate is a marketing tool meant to entice bidders. A formal appraisal, on the other hand, is a thoroughly researched statement of value, prepared for a specific purpose and bound by strict professional standards.

Finding the Right Expert for the Job

Not all appraisers are created equal. You can’t just hire anyone. You need someone with deep, proven expertise in the specific artist or period you're dealing with, and they must adhere to the Uniform Standards of Professional Appraisal Practice (USPAP).

The best place to start your search is with the major professional organizations. They vet their members and provide searchable databases.

- Appraisers Association of America (AAA): The top-tier national association for personal property appraisers.

- American Society of Appraisers (ASA): A broad organization with a highly respected fine art specialty.

- International Society of Appraisers (ISA): Offers robust education and certification programs.

Using their directories, you can find someone who specializes in exactly what you have, whether it’s 19th-century American landscapes or contemporary Japanese ceramics. For anyone just starting out, learning more about the art world and its professionals is invaluable. You can gain some great perspectives by listening to conversations on how to collect art with experienced artists.

What to Expect: The Cost and the Process

So, what does this cost? Reputable appraisers almost always charge by the hour. Rates can range from $150 to over $500 an hour, depending on their experience, location, and specialty.

A huge red flag: Never, ever hire an appraiser who wants to charge a percentage of the artwork’s value. This is a massive conflict of interest.

The process itself is straightforward. It typically starts with an in-person inspection of the artwork. After that, the appraiser conducts deep research into its history and recent sales of similar works. This all culminates in a detailed written report that clearly states the purpose of the appraisal and the final value, giving you the official document you need.

Your Top Art Valuation Questions Answered

Diving into the world of art valuation can feel a bit like learning a new language. Even experienced collectors run into questions. Let's clear up some of the most common points of confusion I hear from people trying to figure out what their art is really worth.

How Much Should I Expect to Pay for a Professional Appraisal?

There’s no single answer here, as the cost can swing quite a bit. It really boils down to the appraiser's experience and the legwork involved. Most credible appraisers charge by the hour, typically somewhere in the range of $150 to $500 per hour. For a world-renowned specialist, you can expect that number to be even higher.

Here’s a critical piece of advice: a trustworthy appraiser will never ask for a fee based on a percentage of the artwork's final value. That’s a massive ethical breach and a conflict of interest. A simple, straightforward appraisal might only take a couple of hours, but a complex piece with a tangled history could easily run up the clock.

Is an Auction Estimate the Same Thing as a Formal Valuation?

Not at all. Think of them as two completely different tools for two different jobs. An auction house gives you an estimate to get things moving. It’s a strategic price range meant to catch the eye of potential buyers and build excitement around a sale. It’s a prediction, not a certified value.

A formal valuation, or appraisal, is a thoroughly researched, legally defensible opinion of value. It’s prepared for specific needs like insurance (Replacement Value) or estate planning (Fair Market Value) and must meet strict professional standards. An auction estimate simply doesn't carry that kind of weight.

Can I Trust a Free Online Art Appraisal?

You've probably seen ads for "free" online appraisals. My advice? Proceed with caution. These are almost always lead-generation tactics used by galleries or auction houses to get your information. You send a few photos, and they give you a quick guess without ever laying eyes on the actual artwork.

While it might give you a rough idea, it’s far from accurate. For anything important—like getting insurance coverage, making a major sale, or donating a piece—you absolutely need a paid appraisal from a certified expert who can inspect the art in person. There's just no substitute.

How Does an Artist’s Career Level Impact an Artwork's Price?

The artist's reputation and career stage are huge factors in determining value. The market tends to group artists into three main categories, and each one comes with its own financial landscape:

- Emerging Artists: These are the new talents on the scene. Prices are lower, which makes it a more accessible entry point for new collectors. The investment is riskier, but the potential for a massive return is there if they break through.

- Mid-Career Artists: These artists have put in the time. They have a solid history of exhibitions, positive reviews, and a recognizable style. Their market is more stable and the value of their work tends to grow steadily.

- Blue-Chip Artists: These are the legends—the household names with decades of museum shows and consistently high auction prices. Their work is seen as a reliable, almost foundational asset in the art world.

At Wiktoria Florek, we believe the true value of art is how it makes you feel. It's about connection. Explore our collection of emotionally charged mixed-media works and discover a piece that speaks to you. Find your masterpiece today.