Unlocking the Art Market's Potential in 2025

The art market offers diverse investment opportunities, and 2025 promises exciting prospects for both established collectors and new entrants. This listicle explores seven key areas ripe with potential. We'll equip you with actionable insights to navigate the evolving art landscape and make informed decisions. Whether you're seeking financial growth or building a culturally significant collection, this guide offers valuable perspectives on where to invest your resources. Understanding the forces shaping the art world is key to making smart investments. We'll cover specific trends, artists, and market segments, providing you with a roadmap for 2025 and beyond. Discover the potential of these seven key areas:

- Digital Art and NFTs

- Emerging Market Contemporary Art

- Art Investment Funds and Tokenization

- Post-War and Contemporary Asian Art

- Photography as Fine Art

- Young Artist Discovery Programs

- Art-Backed Securities and Lending

This listicle provides the insights you need to capitalize on art investment opportunities in 2025. From emerging digital art trends to established Asian art markets, each section offers specific, actionable advice. We'll explore how to identify promising artists, understand market dynamics, and potentially build a valuable collection. Gain a deeper understanding of the art investment landscape and unlock its potential for growth and cultural enrichment.

1. Digital Art and NFTs

Digital art, once a niche interest, has exploded into the mainstream thanks to Non-Fungible Tokens (NFTs). NFTs represent ownership of unique digital artworks on blockchain platforms, providing verifiable provenance and scarcity. Despite market fluctuations, the NFT space is maturing, moving beyond hype and towards real-world utility. This evolution includes integration with gaming, metaverse experiences, and increasing institutional adoption. We're also seeing improved curation on NFT marketplaces, sophisticated provenance tracking, and even the integration of NFTs with physical art collections. This makes digital art, powered by NFTs, a compelling art investment opportunity in 2025.

Examples of Success in the NFT Space

The rise of NFTs has produced some remarkable success stories. Beeple's "Everydays: The First 5000 Days" sold for a staggering $69.3 million, catapulting digital art into the global spotlight. Projects like CryptoPunks regularly see individual NFTs selling for $100,000 or more. Generative art platforms like Art Blocks and programmable art platforms like Async Art continue to push the boundaries of digital creation and ownership. These examples highlight the immense potential, and the growing market value, of digital art.

Investing in Digital Art and NFTs: Actionable Tips

Navigating the NFT space requires careful consideration. Here are some key tips for potential investors:

- Research: Thoroughly investigate the artist's background, their previous work, and their community engagement.

- Established Marketplaces: Use reputable platforms like OpenSea or Foundation to buy and sell NFTs.

- Long-Term Utility: Focus on projects with long-term value propositions beyond short-lived hype cycles. Think about utility, community, and the artist's vision.

- Diversification: Spread your investments across different NFT categories (e.g., art, collectibles, gaming items).

Why Invest in Digital Art and NFTs in 2025?

The ongoing evolution of the NFT ecosystem positions digital art as a unique investment opportunity for 2025 and beyond. As the technology matures and integrates further with various industries, the potential for growth and innovation within the digital art market is significant. From established artists making the digital transition to emerging creators pushing creative boundaries, the space offers a diverse range of investment options.

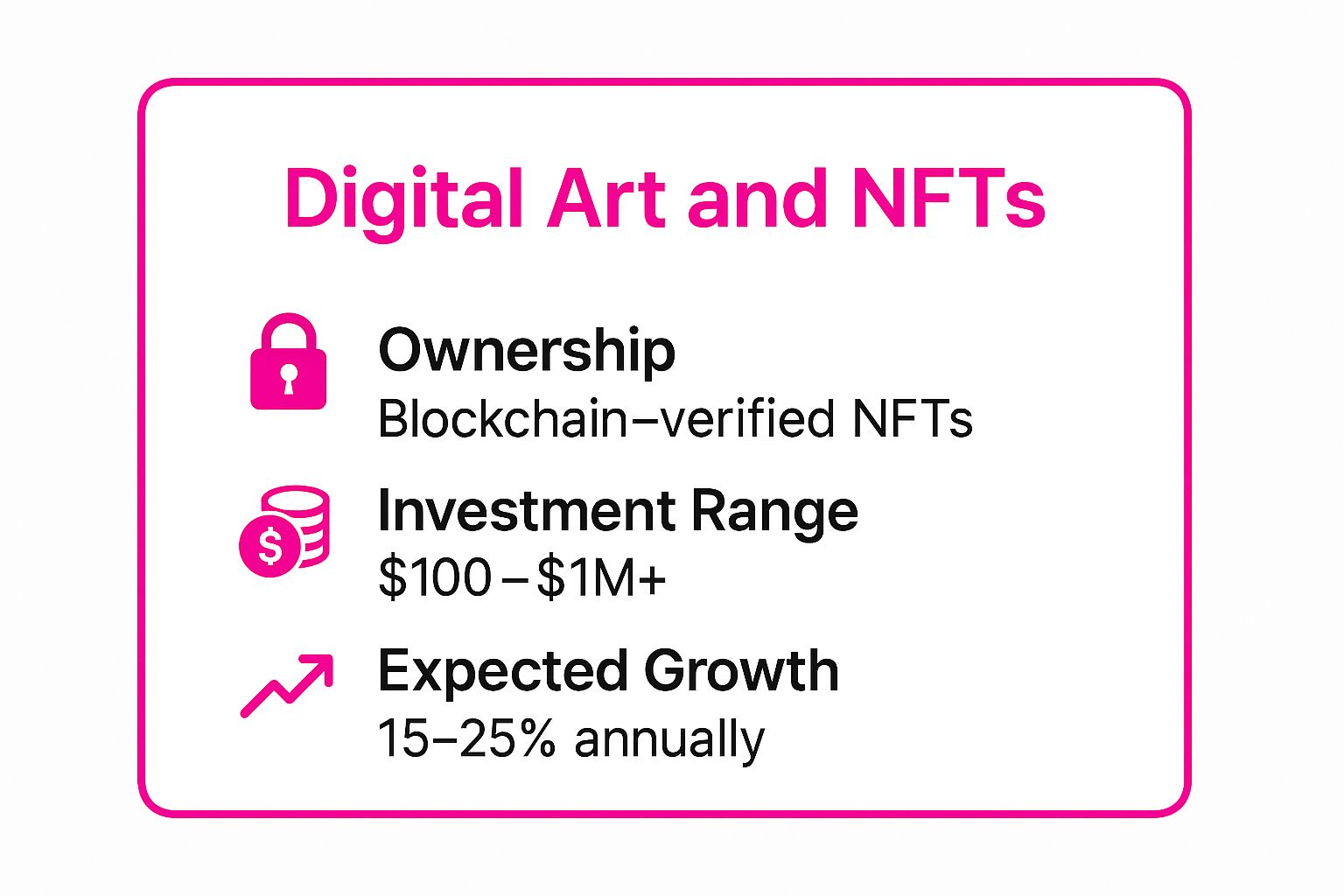

The infographic below provides a quick reference for key data points regarding digital art and NFT investments.

This infographic summarizes the key aspects of digital art as an investment: blockchain-verified ownership through NFTs, a broad investment range from $100 to over $1 million, and an expected annual growth of 15-25%. These figures underscore the potential for substantial returns in the NFT market, even for smaller investments. However, remember that the market is still volatile, and careful research is crucial.

Key Players and Influencers

The NFT art movement has been shaped by influential artists and developers. Beeple (Mike Winkelmann), Pak, XCOPY, Tyler Hobbs, and Dmitri Cherniak are among the key figures who have popularized and pushed the boundaries of digital art and NFTs. Their work has not only achieved remarkable financial success but has also contributed to the wider acceptance and understanding of digital art as a legitimate art form.

2. Emerging Market Contemporary Art

Contemporary art from rapidly developing economies presents a compelling investment opportunity for 2025. Regions like Southeast Asia, Africa, and Latin America are experiencing significant economic growth, and their art markets are mirroring this ascendance. As these regions gain global prominence, collectors are increasingly recognizing the undervalued talent within these markets. Global art institutions are also expanding their focus beyond Western artists, further driving interest and demand.

Examples of Success in Emerging Markets

The growth in these art markets is substantial. African contemporary art, for instance, has seen annual growth rates of up to 30%. The Vietnamese art market has experienced a surge of 40% growth. Latin American art is gaining increased recognition in major museums, and Indian contemporary art is seeing growing institutional adoption. These trends signal the increasing value and potential of art from these regions.

Investing in Emerging Market Art: Actionable Tips

For those looking to invest in emerging market contemporary art, strategic planning is essential. Consider these key tips:

- Partner with Local Experts: Collaborate with reputable galleries and art advisors based in the specific region of interest. Their local expertise and networks are invaluable.

- Attend Regional Art Fairs: Immerse yourself in the local art scene by attending art fairs in these regions. This provides firsthand exposure to artists and their work.

- Research the Context: Understand the cultural and political context surrounding the art. This deeper understanding adds value to your investment decisions.

- International Exhibition History: Focus on artists who have a track record of exhibiting internationally. This signifies broader recognition and potential for future growth.

Why Invest in Emerging Market Art in 2025?

The increasing global interest in art from emerging markets positions it as a prime investment opportunity for 2025. The confluence of economic growth, artistic talent, and expanding institutional recognition creates a strong foundation for long-term value appreciation. As these markets mature and integrate further into the global art world, the potential for significant returns is substantial.

Key Players and Influencers

Several artists have been instrumental in bringing art from emerging markets to international acclaim. El Anatsui from Ghana, Yinka Shonibare from Nigeria, Bharti Kher from India, and Titus Kaphar (US-based, with a focus on African themes) are just a few examples. Their work has not only gained significant recognition but also paved the way for other artists from these regions to gain global visibility.

3. Art Investment Funds and Tokenization

Art investment funds, traditionally accessible only to high-net-worth individuals, are evolving. These funds pool capital to acquire museum-quality artworks. Now, blockchain technology enables fractional ownership through tokenization, democratizing access to blue-chip art for a broader investor base. This innovative approach combines professional management and diversification with the potential for significant returns.

This model allows investors to own a fraction of a valuable artwork, lowering the barrier to entry for art investment. Platforms like Masterworks, with over $800 million in assets under management, exemplify this trend. Other platforms like Arthena utilize AI-driven strategies to identify promising investment opportunities. Tokenization platforms like Mintus further facilitate fractional ownership, opening up new possibilities for art market participation.

Examples of Success in Art Funds and Tokenization

The success of platforms like Masterworks demonstrates the growing demand for fractionalized art ownership. Arthena's use of AI to analyze art market trends offers another example of how technology is transforming art investing. The strong performance of funds like Artemis Art Fund further validates the potential of this investment strategy. This success also emphasizes the shift towards art as an alternative asset class.

Investing in Art Funds and Tokenization: Actionable Tips

For investors interested in art funds and tokenization, due diligence is essential. Carefully compare fee structures across different platforms. Review the fund's track record and understand their investment strategy. Crucially, evaluate the exit strategy, understanding how you can liquidate your investment. Finally, consider the tax implications of investing in art funds and tokenized art.

Why Invest in Art Funds and Tokenization in 2025?

Art investment funds and tokenization offer a unique opportunity in 2025 for both seasoned and new art investors. Fractional ownership provides access to previously unattainable artworks. Professional management brings expertise and diversification. As the art market continues to grow, this approach provides a compelling way to participate with a lower barrier to entry and built-in risk mitigation.

Key Players and Influencers

Key figures like Scott Lynn (Masterworks), Madelaine D'Angelo (Arthena), and Pablo Rodriguez-Fraile (Museum of Crypto Art) are driving innovation in art investment. Their platforms and initiatives are shaping the future of art as an asset class and expanding access to a wider audience. These individuals are at the forefront of democratizing art investment, leveraging technology to create new opportunities.

4. Post-War and Contemporary Asian Art

Post-War and Contemporary Asian art represents a dynamic and increasingly significant segment of the global art market. This category encompasses works by established and emerging Asian artists, particularly those active from 1945 onwards. The market's growth is fueled by rising Asian wealth, a surge in cultural pride, and increasing acquisitions by major museums worldwide. This confluence of factors makes it a compelling art investment opportunity in 2025.

Examples of Success in Asian Art

The Asian art market has witnessed remarkable growth in recent years. Yoshitomo Nara's whimsical yet poignant works have seen valuations appreciate by over 200% in some cases. Zao Wou-Ki has achieved record-breaking prices at auction, solidifying his place as a leading figure in modern Chinese painting. Takashi Murakami's vibrant Superflat style has garnered global acclaim, blurring the lines between high art and popular culture. Yayoi Kusama's immersive installations and iconic pumpkin sculptures continue to draw immense institutional demand. These examples highlight the increasing value and recognition of Asian art on the world stage.

Investing in Asian Art: Actionable Tips

Navigating the Asian art market requires careful research and strategic decision-making. Here are some essential tips for potential investors:

- Museum Representation: Focus on artists whose work is included in prominent museum collections and exhibitions. This signals institutional recognition and can drive value appreciation.

- Provenance: Thorough provenance research is crucial, especially with older works. Verify authenticity and ownership history to mitigate risk.

- Cultural Context: Understanding the cultural context and artistic influences behind the artwork can enhance your appreciation and inform your investment decisions.

- Market Trends: Monitor trends at major Asian art fairs, auction results, and gallery exhibitions to stay informed about emerging artists and market dynamics.

Why Invest in Asian Art in 2025?

The Asian art market displays strong fundamentals, including an expanding collector base and robust institutional support. The increasing global recognition of Asian artists, coupled with the region's economic growth, positions Asian art as a promising investment opportunity for 2025 and beyond. From established masters to emerging talents, the market offers a diverse range of investment options with the potential for significant returns.

Key Players and Influencers

The Post-War and Contemporary Asian art scene has been shaped by influential artists who have achieved international acclaim. Takashi Murakami, Yayoi Kusama, Yoshitomo Nara, Zao Wou-Ki, and Liu Ye are among the key figures who have defined and expanded the boundaries of Asian art. Their works not only command high prices at auction but also influence a new generation of artists, solidifying the lasting impact of Asian art on the global art landscape.

5. Photography as Fine Art

Photography, once considered a purely documentary medium, has firmly established itself within the fine art world. Original photographic prints by recognized artists, both vintage and contemporary, are increasingly sought-after by collectors. Major auction houses now dedicate specialized sales to photography, and museums are expanding their photography collections, solidifying its place in the art historical canon. This growing recognition presents a compelling art investment opportunity in 2025.

Examples of Success in Photography as Fine Art

The photography market has witnessed remarkable growth. Andreas Gursky's large-format prints have fetched over $4 million at auction, demonstrating the potential for significant returns. Cindy Sherman's conceptually driven photography has also seen substantial market appreciation. Even more recently, Richard Prince's Instagram series and the posthumous success of Vivian Maier's street photography highlight the diverse range of photographic art attracting significant investment.

Investing in Photography as Fine Art: Actionable Tips

Investing in photography requires careful consideration. Here are some essential tips:

- Print Quality and Condition: Prioritize prints in excellent condition, free from damage or fading. Assess the quality of the paper and the printing process.

- Edition Sizes: Understand the edition size of the print. Smaller editions generally command higher prices due to their increased scarcity.

- Provenance and Authenticity: Verify the provenance and authenticity of the print. A clear chain of ownership and accompanying documentation is crucial.

- Storage and Conservation: Photographs require specific storage and conservation measures to protect them from light, humidity, and temperature fluctuations.

Why Invest in Photography as Fine Art in 2025?

The increasing institutional recognition of photography as fine art, coupled with growing collector interest, makes it a promising investment opportunity for 2025. As the market matures and more artists explore the medium's creative potential, we can expect continued growth and value appreciation. From established masters to emerging talents, photography offers a diverse range of investment options for discerning collectors.

Key Players and Influencers

Several influential figures have shaped the photography art market. Andreas Gursky, Cindy Sherman, Jeff Wall, Gregory Crewdson, and Hiroshi Sugimoto are among the key artists whose work has achieved critical acclaim and significant market success. Their contributions have helped elevate photography to its current status within the fine art world, influencing both artistic practice and collector interest.

6. Young Artist Discovery Programs

Investing in emerging artists, specifically those under 40 with promising trajectories, presents a high-risk, high-reward art investment opportunity for 2025. This strategy centers on identifying talent before widespread market recognition, allowing for potential significant returns as the artist's career blossoms. It requires diligent research and a keen eye for spotting potential, but the payoff can be substantial. This involves looking at artists represented by reputable galleries, garnering critical acclaim, or receiving institutional recognition.

Examples of Success in Emerging Artist Investment

Several contemporary artists demonstrate the potential of early investment. Jordan Casteel's vibrant portraits have seen a meteoric rise in value. Amy Sherald's career trajectory was significantly impacted by her official portrait of Michelle Obama. Kehinde Wiley's early collectors benefited immensely from his growing prominence. KAWS's journey from street art to museum exhibitions showcases the potential for significant appreciation. These examples underscore the potential returns from investing in emerging talent.

Investing in Emerging Artists: Actionable Tips

Successfully navigating the emerging art market requires a proactive approach. Consider these actionable tips:

- Follow Gallery Emerging Artist Programs: Many galleries feature emerging artists, providing insights into promising talent.

- Attend MFA Thesis Exhibitions: These exhibitions showcase the work of graduating art students, offering a glimpse into the future of the art world.

- Monitor Art Prize Winners: Prestigious art prizes often highlight exceptional emerging artists.

- Track Social Media Engagement: Growing online buzz can indicate an artist's increasing popularity and potential market value.

- Consider Advisory Services: Professional art advisors can provide expert guidance and access to emerging talent.

Why Invest in Young Artists in 2025?

The art market continues to evolve, and 2025 presents a unique opportunity to invest in the next generation of artistic innovators. Identifying promising young artists early can yield substantial returns as their careers progress. This approach allows for acquiring works at a lower price point with the potential for significant appreciation as the artist gains recognition. The key is to combine diligent research with a passion for discovering new talent.

Key Players and Influencers

Various platforms and programs contribute to the discovery of young artists. Gallery emerging artist programs, initiatives like the Saatchi Gallery's New Sensations, and lists like Forbes 30 Under 30 Art all play a crucial role in highlighting rising stars. These platforms offer valuable resources for identifying and investing in the future of the art world.

7. Art-Backed Securities and Lending

Art-backed securities and lending represent a sophisticated approach to art investment. These financial instruments leverage art collections as collateral for loans or are packaged into investment products. This can include art-backed bonds, lending platforms where investors fund art purchases, and securitized art portfolios. These portfolios generate returns through a combination of art appreciation and lending activities. This approach offers investors a way to participate in the art market without directly owning and managing physical artworks.

Examples of Art-Backed Securities and Lending

Several platforms and services facilitate art-backed financing. Arthena is a leading lending platform that connects art owners with investors. Fine Art Wealth Management services offer tailored solutions for high-net-worth individuals and institutions seeking to leverage their art holdings. The art-backed loan market has seen consistent growth, with some estimates indicating annual increases of 15%. Furthermore, institutional art financing programs are becoming increasingly common, demonstrating growing acceptance within the traditional finance sector.

Investing in Art-Backed Securities and Lending: Actionable Tips

Due to the complexities of art-backed finance, careful due diligence is essential. Potential investors should:

- Understand Legal Structures Thoroughly: Scrutinize the legal framework underpinning the security or loan agreement.

- Verify Insurance Coverage: Ensure adequate insurance protects the underlying artwork against damage or loss.

- Review Valuation Methodologies: Understand how the art's value is assessed and the potential for fluctuations in that valuation.

- Consider Tax Implications: Consult with a tax advisor to understand the tax implications of investing in art-backed securities or lending.

Why Invest in Art-Backed Securities and Lending in 2025?

Art-backed securities and lending offer a unique investment opportunity in 2025 for those seeking exposure to the art market with a structured financial approach. As the art market continues to grow and mature, the demand for art-backed financing is expected to increase. This approach offers a potentially lower barrier to entry compared to direct art ownership, allowing investors to diversify their portfolios with art-related assets. It can also provide access to liquidity, using art as collateral without selling the pieces.

Key Players and Influencers

The growth of art-backed finance is driven by traditional wealth management firms expanding into art-related services. Specialized art finance companies are emerging to cater specifically to this niche. Private banks are also increasingly offering art services to their high-net-worth clients. These institutions are shaping the landscape of art-backed securities and lending, providing more accessible avenues for investors to engage with the art market.

Art Investment Opportunities 2025: 7-Option Comparison

| Category | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Digital Art and NFTs | High technical setup (blockchain, wallets) | Moderate to high (crypto platforms, gas fees) | 15-25% annual growth; high volatility | Digital collectors, metaverse integration, speculative investment | Blockchain ownership, global reach, instant transfers |

| Emerging Market Contemporary Art | Moderate (market research, regional partners) | Moderate (local galleries, fairs) | 20-35% annual growth in select markets | Diversification, cultural significance, growth potential | Early entry, undervalued talent, high growth potential |

| Art Investment Funds and Tokenization | Moderate to high (fund management, legal) | Moderate (minimum investments, fees) | 8-15% net annual growth | Investors seeking diversification with professional management | Fractional ownership, risk diversification, access to blue-chip art |

| Post-War and Contemporary Asian Art | Moderate (authentication challenges) | High (museum-level works, provenance) | 12-20% annual growth for established artists | Collectors focused on Asian market and institutional validation | Established market, cultural authenticity, diverse price points |

| Photography as Fine Art | Moderate (print verification, condition control) | Moderate (storage, authentication) | 10-18% annual growth for renowned photographers | Affordable entry, collectors of vintage and contemporary prints | Affordability, institutional support, clear authentication |

| Young Artist Discovery Programs | High (talent scouting, market prediction) | Low to moderate (gallery shows, research) | Highly variable; 0-500%+ potential | High-risk collectors seeking exceptional returns | Early access to talent, portfolio diversification, cultural engagement |

| Art-Backed Securities and Lending | High (legal, valuation, compliance) | High (insurance, storage, legal fees) | 6-12% annual returns through lending | Investors focused on income, asset-backed security | Steady income, professional management, lower volatility |

Navigating the Future of Art Investment

The art market in 2025 presents a dynamic landscape of investment opportunities, ranging from the digital frontier of NFTs to the established realm of Post-War and Contemporary art. This article explored seven key areas, each offering unique potential for growth and diversification. From the burgeoning interest in Emerging Market Contemporary Art and the innovative approach of Art Investment Funds and Tokenization, to the enduring appeal of Photography as Fine Art, the options for art investment are vast and varied.

Key Takeaways for 2025 Art Investment

This overview highlighted the importance of understanding market trends, conducting thorough due diligence, and aligning your investment strategy with your personal artistic preferences and financial goals. Key takeaways include:

- Diversification: Explore different segments like digital art, emerging markets, and traditional art forms to mitigate risk and maximize returns.

- Due Diligence: Research artists, galleries, and market trends thoroughly before making any investment decisions. Consider consulting with art advisors for expert guidance.

- Long-Term Vision: Art investment is a long-term game. Focus on acquiring pieces you appreciate and believe in, recognizing that significant returns may take time.

Actionable Next Steps for Art Investors

To capitalize on the art investment opportunities 2025 presents, consider these next steps:

- Identify your niche: Determine which art segments align with your interests and investment objectives.

- Network and learn: Attend art fairs, gallery openings, and online forums to expand your knowledge and connect with other collectors and experts.

- Start small and diversify: Begin with smaller investments across different segments to gain experience and diversify your portfolio.

The Value of Strategic Art Investment

Mastering these concepts allows you to navigate the complexities of the art market with confidence. By understanding the nuances of each segment, you can make informed decisions that contribute to both your financial portfolio and your personal art collection. Strategic art investment requires a blend of passion, knowledge, and patience.

Embracing the Future of Art Collecting

The art world is constantly evolving, and 2025 promises to be a year of continued growth and innovation. By staying informed, adapting to new trends, and seeking expert advice, you can position yourself for success in this exciting market. Embrace the journey of art collecting, appreciating the cultural and aesthetic value alongside the potential financial rewards.

Looking to add unique and potentially valuable pieces to your collection? Explore the vibrant and emotive abstract works of Wiktoria Florek, a mixed media artist whose pieces resonate with contemporary collectors. Discover her portfolio and potential investment opportunity at Wiktoria Florek Mixed Media Abstract Painter.