Welcome to the vibrant, often misunderstood world of contemporary abstract art. For many, it's a realm of pure emotion and aesthetic pleasure. But beyond the expressive brushstrokes and bold colors lies a powerful and strategic investment opportunity. In today's dynamic economic climate, investors are increasingly looking beyond traditional stocks and bonds for assets that offer not only financial growth but also cultural and personal enrichment. This guide breaks down the compelling financial and personal reasons why to invest in contemporary abstract art today.

We will move directly into actionable insights that demonstrate how this unique asset class can diversify your portfolio, serve as a hedge against inflation, and connect you with the cultural pulse of our time. We’ll explore seven key benefits, including the potential for exponential returns from emerging artists, the expansion of global markets through digital platforms, and the increasing institutional confidence driving market value.

This article provides a clear roadmap for both seasoned collectors and new buyers. We will analyze current market trends and showcase how visionary artists like Wiktoria Florek are shaping the future of this exciting market, making now the perfect moment to consider adding a masterpiece to your collection.

1. Portfolio diversification and inflation hedge

In today's unpredictable economic climate, savvy investors are looking beyond traditional stocks and bonds to protect and grow their wealth. One of the most compelling reasons to invest in contemporary abstract art today is its power as a portfolio diversifier and an effective hedge against inflation. Art is a tangible, alternative asset class that often behaves independently of financial markets, providing crucial stability when stocks or bonds falter.

During periods of high inflation, the value of cash and other currency-based assets erodes. In contrast, hard assets like contemporary art tend to hold or increase their value. This is because art possesses intrinsic cultural and historical significance that isn't tied directly to economic policy or currency fluctuations. As a result, it serves as a reliable store of value.

Proven Performance and Expert Recommendations

The financial world has taken notice. Institutions like the UBS Art Banking division and platforms such as Masterworks have popularized art as a legitimate investment vehicle. The Knight Frank Luxury Investment Index consistently tracks art alongside other luxury assets, highlighting its role in wealth preservation strategies used by high-net-worth individuals, like the family behind the Broad Foundation.

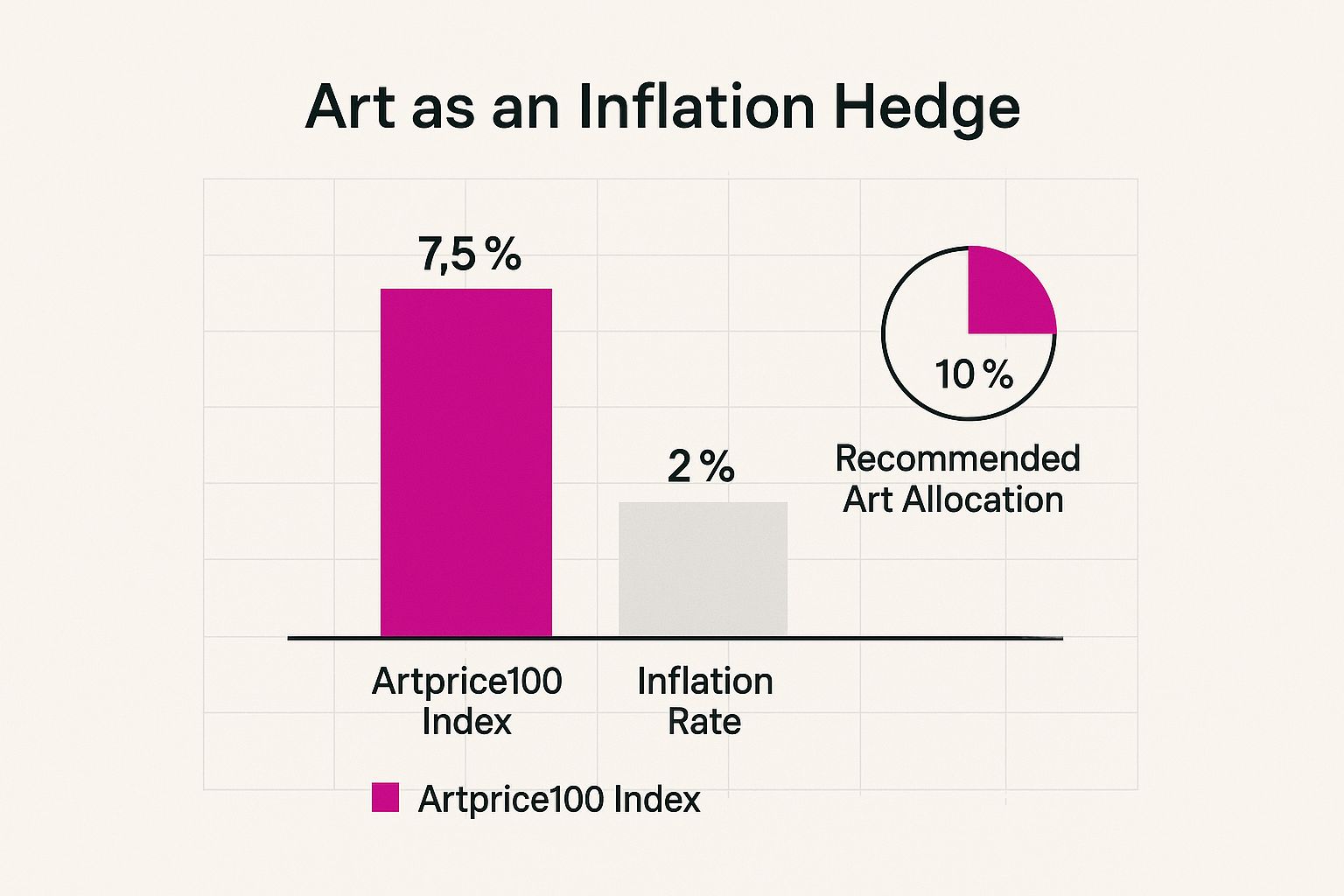

This data chart visualizes the long-term performance of the art market compared to average inflation, alongside a typical portfolio allocation recommendation.

The chart clearly shows that the art market's average annual returns have significantly outpaced inflation over the long term, reinforcing its value as a growth asset.

How to Implement This Strategy

To effectively use contemporary art for diversification, consider these actionable steps:

- Allocate Strategically: Financial advisors often recommend dedicating 5-15% of your total investment portfolio to alternative assets like art.

- Think Long-Term: Art is not a "get rich quick" scheme. Plan for a minimum holding period of 7-10 years to allow for proper value appreciation.

- Work with Experts: Partner with reputable art advisors or consider art investment funds to gain access to market insights and a broader, curated selection of works. This minimizes risk and maximizes potential returns.

2. Emerging artist potential for exponential returns

One of the most exciting reasons why you should invest in contemporary abstract art today is the opportunity to discover emerging artists and achieve potentially exponential returns. Unlike purchasing blue-chip works by established masters, investing in artists early in their careers offers an accessible entry point with significant upside. As these artists gain gallery representation, critical acclaim, and museum exhibitions, the value of their early works can skyrocket.

This strategy involves identifying talent before the broader market does, allowing you to acquire significant pieces at a fraction of their future value. It's a high-growth approach favored by influential collectors and gallerists who understand that betting on talent is a powerful investment thesis.

Proven Performance and Expert Recommendations

The art world is filled with stories of collectors whose foresight paid off handsomely. For example, Kerry James Marshall's paintings, which sold for around $25,000 in the early 2000s, now command millions at auction, with one reaching $21.1 million in 2018. Similarly, KAWS transitioned from a street artist to a global phenomenon, with one of his works fetching $14.8 million. These examples highlight the immense growth potential of backing artists on the cusp of greatness.

Visionary gallerists like Larry Gagosian and David Zwirner, along with renowned collectors like Charles Saatchi, built their legacies by identifying and nurturing emerging talent. They demonstrate that strategic investment in new artists is a cornerstone of building a valuable and culturally significant collection.

How to Implement This Strategy

To successfully invest in emerging artists, you need to combine research with direct engagement. Consider these actionable steps:

- Follow the Indicators: Look for artists graduating from prestigious MFA programs, gaining representation from reputable galleries, or being included in museum acquisitions and notable group shows. These are strong signals of future success.

- Buy the Best You Can: Within your budget, always aim to acquire the most significant work available from an artist you believe in. A stronger piece from a key period in their early career is more likely to appreciate.

- Engage with the Art World: Attend art fairs, gallery openings, and studio visits to discover new talent firsthand. To better understand the artist's perspective, learn more about how to start an art collection from an artist's studio talk.

3. Digital transformation expanding global markets

The art world's digital transformation has revolutionized how contemporary abstract art is discovered, purchased, and traded, creating unprecedented opportunities for investors. The shift online has dismantled traditional geographic and economic barriers, democratizing access to the art market. This digital expansion means a larger, more diverse pool of collectors can participate, increasing liquidity and providing more transparent data for informed decision-making.

This evolution is a key reason why investing in contemporary abstract art today is more accessible and transparent than ever before. Online platforms, virtual viewing rooms, and digital marketplaces allow you to explore a global inventory of artworks from your own home, connecting you directly with galleries, artists, and auction houses worldwide.

Proven Performance and Expert Recommendations

The impact of this digital shift is undeniable. Major auction houses and platforms have embraced technology to fuel massive growth. For instance, Sotheby's reported an 850% increase in its online-only sales between 2020 and 2021, a clear indicator of collector confidence in digital transactions. Marketplaces like Artsy have facilitated billions of dollars in art sales since their inception, providing powerful search tools and market data to collectors.

Furthermore, platforms like Artnet's Price Database offer unparalleled transparency, allowing investors to research an artist's auction history and track market trends. This data-driven approach, once the exclusive domain of industry insiders, is now available to any investor with an internet connection, reducing risk and empowering smarter acquisitions.

How to Implement This Strategy

To leverage the digital art market effectively, focus on due diligence and strategic use of available tools:

- Verify and Compare: Use multiple platforms like Artsy, Saatchi Art, and gallery websites to compare prices for similar works by an artist. Check platform credentials, return policies, and buyer protection guarantees before committing.

- Request Detailed Documentation: Never hesitate to ask for high-resolution images, videos, and a detailed condition report. Reputable sellers will readily provide this information to ensure transparency.

- Combine Digital and Physical: While online research is powerful, try to combine it with in-person viewing whenever possible. Visiting art fairs or gallery shows can provide invaluable context that a screen cannot capture.

- Explore New Frontiers: Investigate emerging digital-native platforms for abstract art, including those specializing in NFTs like SuperRare or Foundation, to gain exposure to the next wave of artistic innovation.

4. Institutional validation driving market confidence

When major cultural institutions like museums, foundations, and prominent corporations acquire art, it sends a powerful signal to the market. This institutional validation is a critical reason why you should invest in contemporary abstract art today, as it significantly boosts an artist's credibility and long-term value. This support acts as a vote of confidence, transforming an emerging artist into a historically significant figure and providing a solid foundation for market stability and growth.

This institutional "seal of approval" reduces investment risk by confirming an artist's cultural relevance and academic importance. When an artist's work enters a major collection, it is preserved, studied, and exhibited for generations, cementing its place in art history. This exposure not only increases demand among private collectors but also solidifies the artwork's financial value, making it a more secure asset.

Proven Performance and Expert Recommendations

The impact of institutional acquisition is clear in the careers of today's most celebrated abstract artists. For example, museums like MoMA and Tate Modern have championed artists like Julie Mehretu and Mark Bradford through major acquisitions and exhibitions, catapulting their market value. Corporate collections, such as the renowned 30,000-piece collection at JP Morgan Chase, further validate artists by integrating their work into prestigious, high-visibility environments.

Philanthropic collectors like Eli and Edythe Broad, through their foundation and The Broad museum, have built collections that essentially define the contemporary canon. Their focused acquisitions of abstract art have created a ripple effect, influencing curators, galleries, and private collectors worldwide and driving market confidence in their chosen artists. The emotional depth and universal themes in abstract art, such as those explored in collections like Wiktoria Florek's Motherhood, often resonate with the curatorial goals of these institutions. You can explore a collection that delves into these powerful themes on Wiktoria Florek's website.

How to Implement This Strategy

To leverage institutional validation for your investment choices, follow these steps:

- Track Museum Activity: Pay close attention to acquisition announcements and press releases from major institutions like the Guggenheim, the Whitney, and international museums.

- Monitor Major Exhibitions: Artists featured in significant biennials (like the Venice Biennale) or major group shows at leading museums are often on the path to institutional recognition.

- Research Corporate Collections: Identify the artists being collected by influential corporations and foundations, as this often precedes broader market growth.

- Follow Curatorial Leaders: Keep an eye on the work championed by influential curators like Klaus Biesenbach and Thelma Golden, whose choices often shape institutional trends.

5. Cultural shift toward contemporary over traditional art

The art market is undergoing a fundamental transformation, driven by a new generation of collectors and evolving cultural tastes. One of the most compelling reasons to invest in contemporary abstract art today is this significant cultural shift. Younger collectors, particularly tech entrepreneurs and those from emerging markets, are increasingly favoring contemporary works over traditional old masters, reshaping demand and value in the art world.

This demographic change means the art being created now, which reflects current social and technological landscapes, resonates more deeply with today’s buyers. Unlike the traditional art market, which can feel inaccessible and stagnant, the contemporary scene is dynamic, global, and digitally native. This sustained interest from a growing base of influential collectors is a powerful catalyst for long-term price appreciation.

Proven Performance and Expert Recommendations

The market’s direction is clear. Influential collectors like Salesforce CEO Marc Benioff and power-collectors Don and Mera Rubell have built world-renowned collections focusing almost exclusively on contemporary art. Major galleries like Gagosian and Thaddaeus Ropac now dedicate their programming primarily to living artists, while leading art fairs such as Art Basel prioritize their modern and contemporary sections.

This trend is also amplified by social media. Platforms like Instagram have become crucial for discovering and promoting contemporary abstract artists, creating a direct and visually driven connection with a global audience. The ability to understand this new visual language is key. For those looking to deepen their engagement, exploring resources on how to interpret abstract art can provide a significant advantage. Understanding the nuances of this art form is a critical first step. For more on this, you can learn more about how to understand abstract art on wiktoriaflorek.com.

How to Implement This Strategy

To capitalize on this cultural wave, investors should adapt their approach to align with modern tastes:

- Focus on Relevant Themes: Prioritize artists whose work addresses contemporary social, political, or technological issues. This art speaks the language of today’s collectors and culture.

- Embrace Digital Shareability: Consider how an artwork translates to digital platforms. Pieces with strong visual impact on-screen often gain traction and visibility faster.

- Follow the New tastemakers: Pay attention to the acquisition patterns of influential contemporary collectors and advisors like Stefan Simchowitz. Their choices often signal emerging market trends.

- Attend Contemporary Fairs: Immerse yourself in the contemporary art scene by visiting fairs like Frieze, The Armory Show, and Art Basel to see what galleries and collectors are excited about.

6. Fractional ownership democratizing access

The high barrier to entry has long been a challenge for aspiring art investors. Today, a new model is revolutionizing the landscape: fractional ownership. This innovative approach allows investors to purchase shares of high-value contemporary abstract artworks, making masterpieces once reserved for the ultra-wealthy accessible to a much broader audience. It’s a powerful reason why investing in contemporary abstract art today is more feasible than ever before.

This democratization expands the investor base and introduces much-needed liquidity into the art market. By owning a piece of a million-dollar artwork, you gain exposure to its potential appreciation without needing to commit significant capital. The assets are professionally managed, from storage and insurance to eventual sale, removing major logistical hurdles for individual investors.

Proven Performance and Expert Recommendations

The concept has been proven and popularized by pioneering platforms that have brought blue-chip art to the masses. Companies like Masterworks, founded by Scott Lynn, have successfully securitized and offered shares in works by contemporary giants like Banksy and Basquiat, opening up the market to SEC-qualified offerings. Other platforms like Rally Rd and Otis have expanded this model to include various cultural assets, including significant contemporary art pieces.

These platforms provide transparency through detailed offering circulars and market analysis, giving investors the data they need to make informed decisions. The success of these models validates fractional ownership as a legitimate and powerful tool for building a diversified, art-focused investment portfolio.

How to Implement This Strategy

To start investing through fractional ownership, follow these strategic steps:

- Research Platforms Thoroughly: Compare the track records, management teams, and fee structures of different platforms. Key players include Masterworks, Rally Rd, and Arthena. Look for transparency in their acquisition and management processes.

- Understand Liquidity and Exits: Each platform has different terms for selling your shares. Investigate their secondary market capabilities and understand the expected holding period and potential exit strategies before committing funds.

- Diversify Your Holdings: Don't put all your capital into a single artwork. Spread your investment across multiple pieces, artists, or even different platforms to mitigate risk and increase your chances of backing a work that sees significant appreciation.

7. Tax advantages and estate planning benefits

Beyond its aesthetic and cultural value, contemporary abstract art can be a remarkably efficient tool for wealth management. For those wondering why to invest in contemporary abstract art today, the answer often lies in its significant tax advantages and estate planning benefits. Strategic art ownership allows investors to reduce tax liabilities, defer capital gains, and create a lasting legacy, transforming a collection into a powerful financial asset.

Unlike many traditional investments, art offers unique pathways for tax efficiency. Through carefully planned donations or estate structuring, collectors can enhance their net returns while supporting philanthropic causes. These financial incentives make art a dual-purpose asset, providing both personal enjoyment and tangible economic rewards.

Proven Performance and Expert Recommendations

The strategic use of art in financial planning is a well-established practice among high-net-worth individuals and promoted by top-tier financial and legal experts. For instance, the late philanthropist Eli Broad famously used his art collection to create a charitable trust, saving his estate millions in taxes while founding a world-class public museum.

Similarly, wealth management firms with dedicated art advisory services and specialists like art lawyer Judith Bresler regularly guide clients through these complex but rewarding strategies. The American Society of Appraisers plays a crucial role by providing the certified valuations necessary to substantiate these tax claims, ensuring compliance and maximizing benefits.

How to Implement This Strategy

To leverage the financial benefits of your art collection, consider these actionable steps:

- Plan Charitable Donations: Donating art to a qualified museum or foundation can allow you to claim a tax deduction for the work's full fair market value, not just its purchase price.

- Explore Deferral Strategies: A "like-kind" exchange under Section 1031 of the U.S. tax code (when applicable) allows you to defer capital gains tax by reinvesting the proceeds from an art sale into a similar piece of art.

- Consult Specialized Professionals: The most critical step is to work with tax advisors and estate planning attorneys who specialize in art. They can help you navigate regulations, structure trusts, and ensure all actions are fully compliant.

7 Key Benefits of Investing in Contemporary Abstract Art

| Aspect | Portfolio Diversification & Inflation Hedge | Emerging Artist Potential for Exponential Returns | Digital Transformation Expanding Global Markets | Institutional Validation Driving Market Confidence | Cultural Shift Toward Contemporary Over Traditional Art | Fractional Ownership Democratizing Access | Tax Advantages & Estate Planning Benefits |

|---|---|---|---|---|---|---|---|

| Implementation Complexity 🔄 | Medium – requires art market knowledge, advisor collaboration | High – needs deep research and artist vetting | Medium – requires digital savvy and platform due diligence | Medium – monitoring institutional activity and trends | Medium – understanding demographic and cultural trends | Low to Medium – platform onboarding and rules compliance | High – complex tax laws needing expert consultation |

| Resource Requirements ⚡ | High – significant capital, storage, insurance, long holding periods | Medium – lower initial investment but long-term commitment | Low to Medium – internet access and device; virtual interaction | Medium to High – access to institutional networks and info | Medium – engagement at fairs, research, and community building | Low – small capital needed; platform fees apply | Medium – appraisal costs, legal fees, and professional advice |

| Expected Outcomes 📊⭐ | Moderate – steady inflation hedge and portfolio risk reduction | High – potential for very high returns but with high risk | Moderate to High – expanded market access and transaction ease | Moderate to High – value stability and credibility boost | Moderate – growing demand and social relevance | Moderate – access to high-value art and some liquidity | Moderate – enhances net returns via tax efficiencies |

| Ideal Use Cases 💡 | Wealth preservation, inflation protection, portfolio diversification | Long-term capital growth by investing in emerging talents | Democratizing art investment and discovery globally | Investors seeking market confidence via institutional backing | Collectors attracted to contemporary relevance and trends | Small investors seeking exposure to high-value art | Investors focused on tax optimization and estate planning |

| Key Advantages ⭐ | Inflation protection, diversification, cultural value | Exponential ROI potential, artist relationship building | 24/7 global marketplace, transparency, lower transaction costs | Price floors, provenance, risk mitigation via institutions | Growing collector base, social media amplification | Accessibility, diversification, professional management | Tax deductions, capital gains deferral, estate tax benefits |

| Key Disadvantages 🔄 | Illiquidity, high fees, storage/maintenance costs | High risk of failure, long recognition timeline | Lack of physical inspection, platform dependency | Institutional bias, market concentration, price inflation | Trend volatility, oversaturation, less historical validation | No physical art possession, fees, limited control over sales | Complex regulations, appraisal requirements, IRS scrutiny |

The Art of the Matter: Your Next Investment

The journey through the world of contemporary abstract art reveals a landscape rich with opportunity. We've explored the compelling, multifaceted reasons why investing in contemporary abstract art today is not just a viable financial strategy, but a deeply rewarding personal endeavor. This is an asset class that defies simple categorization, operating at the powerful intersection of culture, emotion, and economics.

Moving beyond traditional stocks and bonds, contemporary art offers a tangible hedge against inflation and a powerful tool for portfolio diversification. The art market, once seen as opaque and exclusive, is now more transparent and accessible than ever. Digital transformation, the rise of institutional investment, and the democratization of ownership through fractional shares have all dismantled old barriers, inviting a new generation of collectors to participate.

Key Takeaways for the Modern Investor

Let's distill the core insights from our discussion into actionable takeaways:

- Financial Resilience and Growth: Abstract art, particularly from emerging artists, provides a unique opportunity for non-correlated returns. It protects wealth from market volatility while offering the potential for significant appreciation as an artist's career gains momentum.

- Market Momentum is Now: A clear cultural shift favors contemporary works. Major institutions are dedicating more resources to modern artists, and a new wave of collectors, driven by personal connection and aesthetic value, is fueling demand. This growing validation provides a solid foundation for market confidence.

- Accessibility and Strategy: Investing is no longer limited to the ultra-wealthy. With options like fractional ownership and expanded online marketplaces, entry points are more varied. Furthermore, strategic benefits like tax advantages and estate planning make art a sophisticated tool for managing wealth.

Investor Insight: The most successful art investments are born from a blend of diligent research and genuine passion. Your goal should be to find works that not only have strong market potential but also resonate with you on a personal level.

Your Next Steps into the Art World

Feeling inspired to take the next step? The path to becoming an art investor is clearer than you might think. Begin by immersing yourself in the market. Follow leading art world publications, attend virtual gallery openings, and explore online art platforms. Identify a niche or style within abstract art that captivates you, and start researching the artists leading that movement.

Most importantly, understand that you are not just buying an object; you are acquiring a piece of cultural dialogue. You are supporting an artist's vision and participating in the creation of future history. The reasons why you should invest in contemporary abstract art today are as much about enriching your life as they are about enriching your portfolio. The time to begin this vibrant journey is now.

Ready to discover an artist whose work embodies the energy, depth, and investment potential of contemporary abstract art? Explore the portfolio of Wiktoria Florek Mixed Media Abstract Painter, where each piece offers a unique narrative of texture, color, and emotion perfect for both new and established collectors. Begin your art investment journey by discovering a work that truly speaks to you at Wiktoria Florek Mixed Media Abstract Painter.