Why Smart Investors Are Turning to Art

While most investment portfolios are filled with stocks and bonds that exist only as digital lines on a screen, a growing number of investors are diversifying with physical assets. They are discovering that art as an alternative investment provides a unique combination of benefits—it engages the spirit while also offering the potential for significant financial growth.

The Dual Appeal of Aesthetic and Financial Returns

One of art's most powerful features is its ability to diversify a portfolio. The value of art often moves independently of the stock market, which means it can act as a stabilizing anchor when financial markets get rocky. This low correlation with traditional assets makes art a thoughtful hedge against inflation and economic downturns.

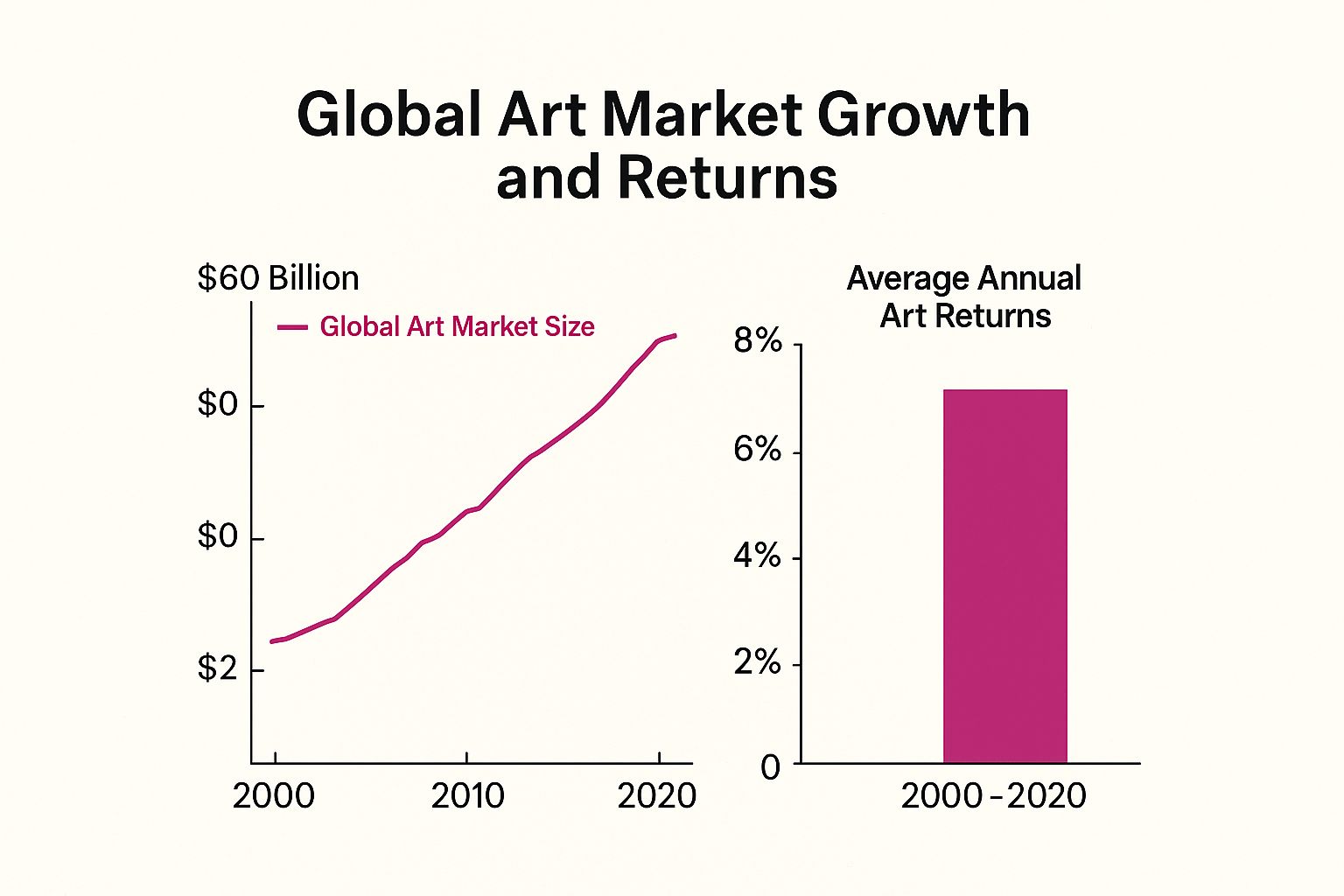

The long-term growth of the art market has caught the attention of serious investors, a trend supported by compelling industry data.

This chart shows a clear expansion in the market's size and steady average returns over two decades. Even when the market experiences natural cycles, the fundamental interest from collectors remains solid. For example, while global art sales totaled USD 57.5 billion in 2024—a 12% decrease from the prior year—the actual number of artworks sold increased by 3%. This points to a resilient and active community of buyers, a key sign of a healthy market. You can find more details on these trends in this complete art market report.

A Comparative Look at Asset Performance

To see where art fits into a modern investment strategy, it's helpful to place it alongside more conventional assets. Each investment type has its own character, with different risk levels and return potentials suited to various financial goals. The following table provides a clear comparison showing how art investments stack up against stocks, bonds, and real estate in terms of liquidity, returns, and risk factors.

Art Investment vs Traditional Assets Comparison

| Asset Type | Average Annual Return | Liquidity Level | Market Volatility | Tangible Value |

|---|---|---|---|---|

| Art | Moderate to High | Low | Moderate | High |

| Stocks | High | High | High | None |

| Bonds | Low | High | Low | None |

| Real Estate | Moderate | Low | Moderate | High |

This comparison highlights art's distinct profile. While it isn't as easy to sell quickly as stocks or bonds, it has return potential similar to real estate and, crucially, a physical presence that financial instruments can't offer. This makes it a well-rounded option for those focused on long-term growth.

Beyond the Balance Sheet: The Value of Tangible Ownership

Unlike a stock certificate that you file away or a number on a screen, a piece of art is an investment you can live with and appreciate every day. This introduces the powerful idea of the emotional dividend—the personal satisfaction and cultural enrichment that comes from owning something beautiful and meaningful. It’s an asset that pays you back through both financial appreciation and daily inspiration.

This dual return is what makes art such a compelling investment. You're not just buying a line item on a spreadsheet; you're acquiring a piece of an artist's story and a cultural artifact. It becomes a conversation starter, a source of personal joy, and a legacy to pass on to future generations, all while acting as a store of value. The key takeaway is that art has the unique ability to enrich your life and your portfolio at the same time.

Spotting Tomorrow's Blue-Chip Artists Today

Investing in art from established masters is a bit like buying blue-chip stocks—it's a relatively safe bet, but the cost of entry is steep. The real chance for significant growth in art as an alternative investment comes from identifying the next wave of important artists before they become household names. This takes a forward-thinking approach, focused on new talent and developing trends.

The Digital Shift: A New Frontier for Collectors

The once-exclusive art world, guarded by brick-and-mortar galleries and physical auctions, is undergoing a massive transformation. The internet has knocked down the old barriers, forging direct connections between artists and collectors. Online platforms and digital galleries now provide remarkable access, letting investors discover talent from all corners of the globe.

This isn't a minor tweak—it's a deep restructuring of the market. Projections indicate that by 2025, 43% of galleries intend to expand their online sales channels. This move toward greater transparency levels the playing field for new investors. You can explore more insights on these market trends to see how the landscape is changing. For a smart collector, this means great art is no longer limited to a few major cities.

Identifying Key Growth Areas in the Art Market

With this new level of access, the obvious question is: where should you look? While the market for names like Monet or Picasso is firmly set, some of the most compelling opportunities are in categories that are just now getting their due. Experienced collectors are shifting their focus to regions and movements that were previously on the sidelines.

For instance, contemporary African art has experienced a boom in global appreciation, with its artists showing up in major international exhibitions. In a similar way, artists from Eastern Europe are offering fresh viewpoints that connect with a worldwide audience. Another key area is the emergence of artists who skillfully combine classic techniques with contemporary ideas, as seen in complex mixed-media abstraction.

These niches often provide a lower barrier to entry but hold a higher potential for value increase as they move into the mainstream. The strategy is to spot the cultural dialogues and artistic styles that are building momentum.

Hallmarks of a Promising Emerging Artist

Pinpointing a future blue-chip artist isn't pure luck; it's about recognizing a set of clear indicators. Think of it as performing your due diligence. Beyond simply enjoying the work, you should search for evidence of a serious and developing career. A promising artist shows a dedication that extends beyond just making pretty things.

When you assess a potential art investment, consider these markers:

- A Cohesive and Evolving Style: The artist has a distinct visual voice, but it isn't stagnant. You should be able to see a clear progression and exploration in their body of work.

- Professional Engagement: They are active in the art community. This could mean participating in group shows, completing artist residencies, or being represented by an up-and-coming gallery.

- Critical or Curatorial Interest: Their work is getting noticed. Are critics writing about them? Is their art being included in curated online shows or purchased by respected collectors?

- A Clear Artist Statement: They can explain the ideas and motivations that drive their work, which signals depth and clear intention.

These qualities are your guideposts. When an artist's vision connects with you personally, these indicators can validate that your gut feeling is on the right track. Looking through the portfolios of emerging artists with original works for sale is a great way to see how a strong artistic voice develops into a compelling collection.

Spotting tomorrow's stars today is the most exciting way to engage with art as an alternative investment. It marries the thrill of discovery with the possibility of impressive financial returns, making your portfolio a reflection of both your taste and your foresight.

Measuring Success Beyond the Price Tag

Figuring out an artwork's true value is more involved than just looking up a stock price. It’s an interesting mix of concrete data and informed judgment. Think of it like appraising a vintage car; you look at its condition and mileage, but its racing history and previous owners are what make it truly special. When it comes to art as an alternative investment, the story behind the canvas is as vital as the image on it.

This combination of factors is what shapes an artwork's financial potential over time. By learning how to read these signals, you can move past the surface and begin to identify real quality.

The Anatomy of Art Valuation

So, what are the key features that drive an artwork's value? Just as a business has its fundamentals, investment-grade art has its own set of value markers. These attributes help separate pieces with long-term potential from those that are merely decorative.

Here are the primary factors that build value:

- Provenance: This is the artwork's official ownership history. A clean, documented trail leading back to the artist, especially one that includes respected collectors or galleries, acts as a powerful seal of authenticity and importance.

- Exhibition History: A piece that has been displayed in a well-regarded museum or a major gallery gains significant credibility. This public showcase is a strong endorsement from a trusted institution, confirming its cultural relevance.

- Critical Recognition: When influential art critics, curators, or academics write about an artist's work, they are cementing its place in art history. This scholarly attention is a strong signal of lasting importance.

- Market Demand: Ultimately, value is confirmed when people are willing to pay for it. Public auctions are where demand is most visibly tested and where record-breaking sales often occur.

Auction sales are a major force, and some estimates suggest they will make up 30-35% of all art market transactions by 2025. The widely publicized sales of artists like Jean-Michel Basquiat and David Hockney don't just set records for a single piece; they create a ripple effect that lifts the value of their other works. This shows how strong public demand can solidify an artist's financial standing. You can explore the latest art market analysis to see more on these trends.

Tracking Performance with Data

Smart collectors don't operate on gut feelings alone; they use data to measure performance. Much like the S&P 500 tracks the stock market, various art market indices gather auction data to reveal trends for different artists and categories. This data-driven approach helps investors see which segments are growing.

To give you a clearer picture, the table below shows how different art categories have performed over time, each with its own risk and return profile.

Art Investment Performance by Category

| Art Category | 5-Year Return | 10-Year Return | Market Share | Risk Level |

|---|---|---|---|---|

| Contemporary Art | ~12.5% | ~9.8% | High | Moderate-High |

| Post-War Art | ~9.2% | ~8.5% | High | Moderate |

| Impressionist Art | ~4.5% | ~5.1% | Medium | Low |

| Emerging Artists | Varies Widely | Varies Widely | Low | Very High |

As the data shows, contemporary art has offered higher recent returns but comes with more risk. In contrast, Impressionist art provides more stability, appealing to a more conservative investor. Emerging artists represent the highest risk but also the potential for outsized, though unpredictable, returns.

Distinguishing Genuine Growth from Speculation

Finally, a sharp investor must learn to tell the difference between genuine appreciation and a speculative bubble. True value is built on a solid foundation of the factors we've covered—provenance, critical acclaim, and exhibition history. A speculative bubble, on the other hand, is fueled by marketing and hype, causing prices to climb without any real support.

A major red flag is when an artist’s prices shoot up without any corresponding museum acquisitions or major new shows. The goal is to find work poised for steady, long-term appreciation, not chase a risky, hype-driven flip.

Protecting Your Investment From Common Pitfalls

Every great investment comes with its own set of warnings, and art as an alternative investment is no different. The path to a profitable collection is paved with due diligence, and avoiding a few common missteps can be the difference between a masterpiece and an expensive mistake. Understanding these challenges is the first step to protecting your collection.

The Critical Importance of Provenance and Authenticity

Think of an artwork’s provenance as its official biography—a complete, documented history of ownership that traces the piece all the way back to the artist's studio. A piece with a clear, unbroken provenance, supported by evidence like original gallery receipts or auction catalog entries, has a powerful stamp of legitimacy that directly boosts its value. This chain of custody is your best assurance of authenticity.

On the other hand, major gaps in this history are a serious red flag. An undocumented period could mean the piece is a clever forgery, was previously stolen, or is simply misattributed to the wrong artist. Without a clear trail of ownership, even a beautiful painting can become nearly impossible to sell, as respected auction houses and galleries will likely refuse to handle it.

Condition, Conservation, and Hidden Costs

Unlike a stock certificate, a physical work of art is vulnerable to the effects of time and its environment. A small tear, subtle water damage, or a clumsy restoration job can seriously diminish a piece's value. Before buying any artwork, a detailed condition report from a professional conservator is absolutely essential. This report is like a home inspection for art, pointing out any existing damage or past repairs that could affect its future worth.

Many new collectors get so focused on the purchase price that they forget about the ongoing costs of ownership. These expenses are significant and must be part of your investment plan.

- Specialized Insurance: Your standard homeowner's policy is unlikely to provide adequate coverage for fine art. You'll need a dedicated policy that covers potential damage, theft, and transit at an agreed-upon value.

- Proper Storage: Art requires a stable environment to avoid damage. Fluctuations in temperature and humidity can crack paint or warp a canvas, while direct sunlight can cause irreversible color fading.

- Professional Conservation: Over the years, artworks may require professional cleaning or minor repairs from a trained expert to preserve their physical and visual integrity.

Think of these expenses as the necessary upkeep to protect both the physical health of your artwork and its long-term financial potential.

Recognizing Market Manipulation

The art market, while more open than it once was, is not entirely free from manipulation. Investors need to be aware of tactics used to artificially inflate prices. A common scheme is the "pump and dump," where a group of speculators buys up an artist's work to generate buzz and drive prices higher, only to sell—or "dump"—their pieces at the peak, leaving other buyers with overvalued art.

Another method involves creating artificial scarcity by keeping an artist's most important works out of the public eye. To protect yourself, look for artists who have a consistent career path and support from established institutions, not those with sudden, unexplained price surges.

Your best defense is a combination of independent research and healthy skepticism. Always rely on your own appraisals, check verifiable auction records, and seek out advice from impartial experts who have no financial stake in the sale.

Your First Steps Into Art Investment

Making the move from someone who simply admires art to someone who actively invests in it is an exciting step. But this journey isn't about guesswork; it's about building a smart strategy from the ground up. This guide will walk you through the essential steps, from setting a realistic budget to confidently selecting your first piece.

Setting Your Budget and Timeline

Before you get attached to a specific artwork, you need to define your financial game plan. It's best to view art not as a quick flip, but as a long-term asset, much like real estate or private equity. Most financial advisors suggest that alternative investments, art included, should only make up about 5-10% of your total portfolio.

This guideline helps manage risk while still allowing you to get into the market. It’s also important to understand that art is an illiquid asset—meaning you can’t sell it for cash at a moment's notice. You should be prepared for an investment timeline of 7-10 years or more to give the work a real chance to appreciate. This long-haul perspective is key to a successful art investment strategy.

Researching and Evaluating Your First Piece

Once your budget is clear, the real adventure begins. This is where your personal taste meets practical analysis. The goal is to discover artists who have a clear vision and a developing career, as these are strong indicators of future growth. Look for artists who have a consistent body of work, participate in gallery exhibitions, and are gaining attention from critics.

Learning to evaluate the artwork itself is an equally vital skill. It requires looking beyond its decorative appeal to understand the artist's technique, concept, and intention. For many new collectors, contemporary styles like abstraction can seem difficult to approach. Taking time to learn how to understand abstract art can unlock a deeper appreciation and empower you to assess pieces with more confidence.

Navigating Your Purchasing Options

Where you buy art is just as important as what you buy. Every channel offers a unique experience with different benefits and drawbacks.

- Galleries: Buying from a respected gallery means you get a curated selection. The gallerist has already done the work of vetting the artist, and you can benefit from their knowledge. However, the price will include the gallery’s commission.

- Auction Houses: Auctions offer transparent pricing and the opportunity to buy works on the secondary market. The main thing to watch out for is "auction fever"—getting swept up in a bidding war. Also, remember to account for the buyer's premium, which can add 20-25% to the final hammer price.

- Online Platforms: Websites and digital marketplaces provide incredible access to artists from around the globe. The key here is to do your homework, as you are responsible for confirming the piece's condition and authenticity on your own.

- Direct from the Artist: Buying directly from an artist's studio can create a strong personal connection to the work and often comes at a lower price. This is a common path for acquiring pieces from emerging artists who are not yet represented exclusively by a gallery.

The Practical Side of Ownership

Your investment doesn't stop once you've bought the piece. Owning a physical asset comes with ongoing costs that you must factor into your budget. This includes professional packing and shipping, specialized fine art insurance to protect against theft or damage, and potential conservation work in the future to maintain the artwork's condition.

Building a Collection That Works and Pays

Think of a great art collection less like a room full of pretty pictures and more like a high-performing investment portfolio. Building one that truly pays off means moving beyond simply buying what you like. It requires a clear plan that marries your personal taste with smart financial goals, turning a group of objects into a valuable, growing asset.

Finding the Sweet Spot: Passion and Profit

The most rewarding art collections are born where love and logic meet. Instead of a random gallery of pieces you like, imagine your collection as a cohesive story. Perhaps it centers on a specific movement, a medium like mixed media, or artists from a particular region. A focused collection is often worth more than the sum of its parts.

This approach to art as an alternative investment demands patience. This isn't a get-rich-quick scheme; art is not a liquid asset. Returns are usually seen over a long-term horizon, typically 7-10 years. The goal is to find pieces you'll love living with for a decade or more, which also align with your financial strategy.

How to Actively Manage Your Art Assets

Active management is what separates a serious collection from a simple hobby. To protect its value and track its performance, you need to stay on top of a few key tasks.

- Keep a Digital Record: Use cataloging software to create a detailed inventory. For every piece, you should log the artist, title, size, purchase price, date, provenance (its history of ownership), and have high-quality photos.

- Get Regular Valuations: Every 3-5 years, or whenever you update your insurance, have a professional appraise your collection. This gives you an accurate market value for both strategic planning and your estate.

- Guard Your Paperwork: Keep every receipt, certificate of authenticity, exhibition record, and condition report in a safe place. This paperwork is the bedrock of an artwork’s value and authenticity.

- Protect Your Investment: Secure a specialized fine art insurance policy. Just as important is creating a stable environment for the art itself, keeping it away from direct sunlight and sharp changes in humidity.

Strategic Moves: Buying, Holding, and Selling

A great collection is rarely static. At some point, you may decide to sell a piece. This process, known in the art world as deaccessioning, isn't a sign of failure. It’s a smart, strategic move to sharpen your collection’s focus, cash in on an investment, or raise funds for an even more important purchase.

Making these calls requires a real feel for the market. To get an insider’s perspective, it can be incredibly helpful to understand how artists themselves think about collecting. You can get this behind-the-scenes view when you read a studio talk about how to collect art. This kind of context adds depth to your own choices, which can be further supported by modern tools that analyze auction data to spot trends.

The key takeaway is that a well-managed art collection is a living asset. It demands attention, strategy, and a smart blend of artistic appreciation and financial discipline to grow in both cultural and monetary value.

Your Action Plan for Art Investment Success

Knowing the theory is one thing, but turning that knowledge into a smart, long-term investment strategy is where success truly happens. A disciplined plan is what separates a serious art investor from a casual hobbyist. This framework will guide you in making solid decisions, helping you build a collection that brings both personal fulfillment and financial growth.

A Pre-Purchase Checklist for Smart Acquisitions

Before you fall in love with a piece and reach for your wallet, pause. Every potential purchase should pass a strict evaluation. Think of this checklist as a pilot's pre-flight inspection—it's your essential check to prevent an emotional decision from becoming a costly error and to ensure every new piece strengthens your portfolio.

- Artist Due Diligence: Look beyond a single painting you like. Does the artist have a consistent history of exhibitions? Is their work evolving in a clear direction? Are critics, curators, or galleries taking notice? You are investing in their entire career, not just one piece.

- Provenance and Documentation: Can the seller show you a clear, unbroken chain of ownership? Always insist on seeing the supporting paperwork, including certificates of authenticity and past sales records. Gaps in an artwork's history are a major red flag.

- Condition Report: This is non-negotiable. Always get a detailed condition report from a neutral, third-party art conservator. This document will reveal any hidden damage or shoddy restoration work that could devastate the artwork's future value.

- Budget Alignment: Does the final price fit within your established budget? Remember to factor in all the extra costs—framing, shipping, and insurance. At an auction, the buyer’s premium can add a hefty 20-25% to the hammer price. Know your total cost before you commit.

Cultivating Your Network and Credibility

In the art world, who you know can be just as important as what you own. Building your reputation opens doors to better opportunities and insider information. Start by genuinely connecting with the community. Visit local galleries, attend major art fairs, and introduce yourself to gallerists and respected advisors.

Follow artists and curators you admire on social media to get a feel for the current conversations. When you speak with a dealer, show them you have done your homework. Instead of asking, "What's hot?" ask about an artist’s latest body of work or their upcoming exhibition schedule. This signals you are a serious collector, not a trend-chaser, and helps build the trust that can make you a preferred client.

Measuring Progress and Knowing When to Adjust

A successful art portfolio is not something you can "set and forget." It’s more like tending a garden; it requires regular attention to thrive. You need to establish clear benchmarks to track how your collection is performing over time.

Schedule a professional appraisal of your collection every 3-5 years. This gives you an updated, objective market value, which is absolutely essential for insurance purposes and for making smart decisions about what to buy or sell next.

Beyond formal appraisals, actively follow the careers of the artists you've collected. Are they being featured in important museum exhibitions? Are their auction prices climbing steadily? Red flags could include a sudden price slump or if an artist stops producing work for a long time. Your investment strategy should be alive and ready to adapt to market changes.

This structured approach turns a passion for art into a professional practice. It’s about making deliberate, well-researched choices that build a collection with lasting meaning and financial weight. The first step in this journey begins with discovering art that truly speaks to you.

Explore the powerful, emotionally resonant world of Wiktoria Florek's mixed media works and find a piece that could become the cornerstone of your collection. Discover her original art today.